Co-authored by Jennifer Lee, senior policy analyst for higher education

Casino gambling is not a stable, adequate or fair source of revenue. In addition to being highly volatile, the legalization of casino gambling could cause significant harm to Georgians, including families and small business owners. Casino gambling risks influence from large out-of-state corporations and disproportionate harm to low-income communities while offering only a relatively small potential revenue contribution to the state.

Casino revenue is unstable. During the COVID-19 pandemic, the casino industry has experienced some of the highest levels of volatility in the nation, with corporations like MGM recording quarterly revenue drops as large as 91 percent.[1] Even if casino revenues are earmarked to fund critical services and programs, such as education and health care, lawmakers—or a powerful state gaming commission—could still reduce casino tax rates or use funds for other programs through legislation or through broad powers.

Casino revenue is inadequate. Over the long run, casino revenue declines as markets saturate. States with casinos in place before 2008 saw a 26 percent decline in tax and fee revenue between 2008 and 2015. In Louisiana, casino tax and fee revenue decreased 10 percent from 2008 to 2015.[2] Casino gambling could also compete with and reduce lottery revenues. Regardless of the tax rate applied, past estimates of potential revenue generated by casinos are far less than the state currently raises from the lottery, which raised over $1.3 billion last year (equivalent to about 5 percent of state revenues).

Casino revenue is unfair. People with lower incomes and problem gamblers are likelier to spend a greater share of their earnings on gambling. A host of social and economic harms have been documented related to problem gambling, including debt, damaged relationships and suicide.[3] Income and job growth would be limited by weak labor protections in the state and the growth of automated forms of gambling, which requires fewer workers.

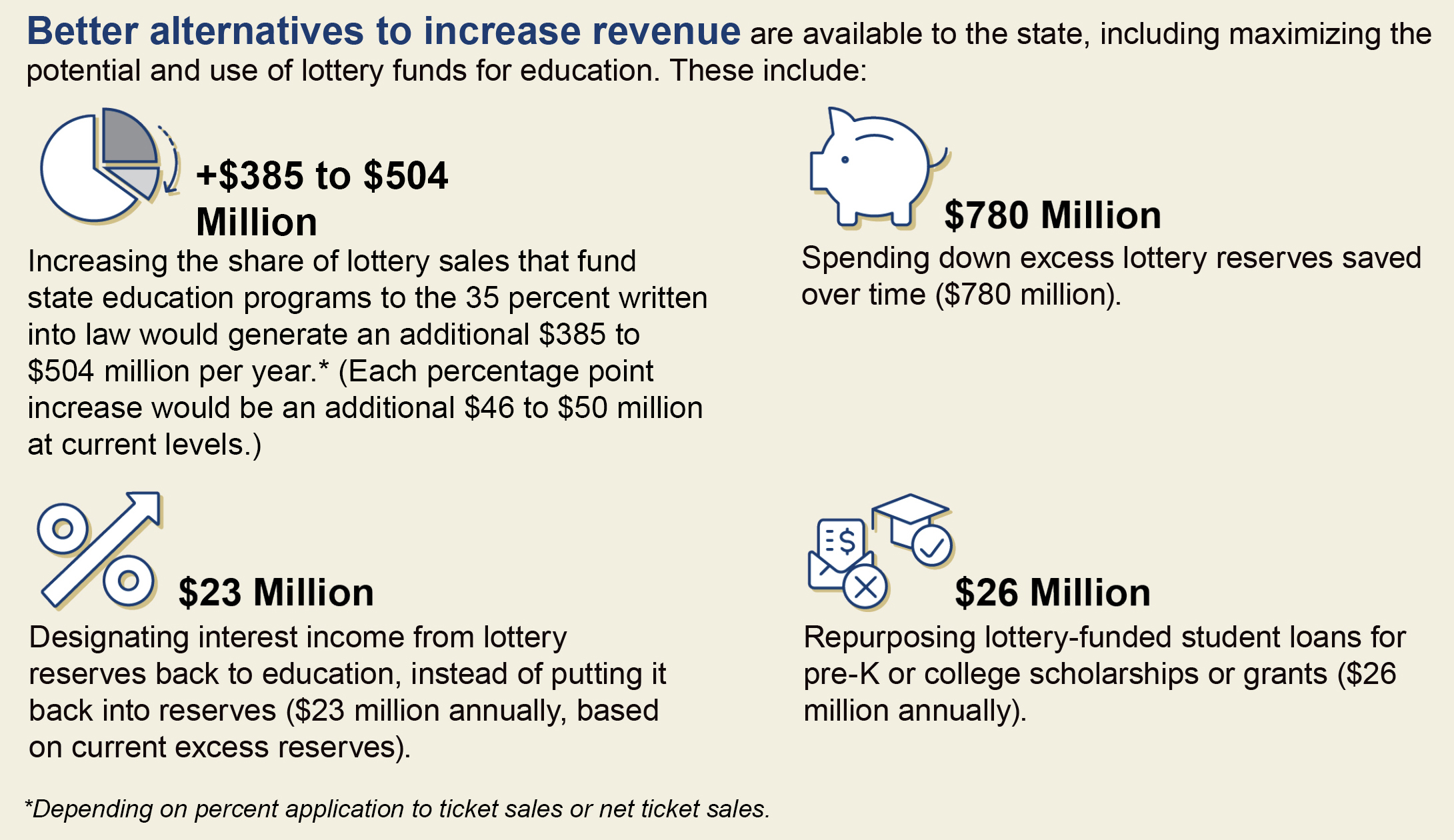

Disparities between who pays into and who receives benefits from the lottery should be reduced through more spending in pre-K, technical colleges and need-based grants and scholarships. Individuals with lower incomes tend to spend more of their income on lottery. But people from high-income families are more likely to get lottery-funded scholarships: 31 percent of University System of Georgia students from families with over $120,000 annual income received full-tuition, lottery-funded scholarships.[4] In contrast, Georgia counties where lottery spending is highest have significantly higher levels of poverty and unemployment, and lower median household incomes.[5]

Endnotes

[1] Sayre, K. (2020, July 30). Casino operator MGM Resorts’ revenue falls 91%. MarketWatch. https://www.marketwatch.com/story/casino-operator-mgm-resorts-revenue-falls-91-2020-07-30

[2] Dadayan, L. (2016). State revenues from gambling: Short-term relief, long-term disappointment. Appendix Table 8. The Nelson A. Rockefeller Institute of Government, The State University of New York. https://rockinst.org/wp-content/uploads/2017/11/2016-04-12-Blinken_Report_Three-min.pdf

[3] Latvala, T., Lintonen, T. & Konu, A. (2019). Public health effects of gambling – debate on a conceptual model. BMC Public Health 19, 1077. https://doi.org/10.1186/s12889-019-7391-z

[4] Jones, T. R. (September 2020). Post-secondary financial aid foundational report: 2013-14 to 2018-19. Georgia Policy Labs, Child & Family Policy Lab. https://gpl.gsu.edu/publications/post-secondary-financial-aid/

[5] Johnson, C.D. (2012, April 16). HOPE for whom? https://gbpi.org/wp-content/uploads/2012/04/HOPE-for-Whom-Lottery-Report04162012.pdf