Key Takeaways

- Members of the House and Senate are debating a series of major changes to Georgia’s personal income tax in HB 1437.

- Proposals to shift Georgia’s current graduated income tax, where rates increase from 1 to 5.75 percent as income increases, to a flat tax carry high costs to the state and would primarily benefit the wealthiest through reductions to the state’s top income tax rate.

- Members are also considering ways to consolidate itemized tax deductions, which currently primarily benefit higher-income tax filers, with a higher standard exemption offered to all taxpayers.

- The Senate version of the legislation includes a non-refundable Earned Income Tax Credit (EITC) at 10 percent of the federal level, which would focus tax relief on low- to moderate-income Georgians. Legislators can strengthen this provision to make the credit fully refundable. They can deploy federal funds received by the state through the American Rescue Plan.

- Proposals advanced by both the House and Senate range in cost from $1 billion to $2 billion in potential revenue losses per year, which would mark a dramatic reduction in state revenues and threaten Georgia’s ability to meet its budget obligations if fully implemented.

- Legislators should focus on combining elements of both proposals to center the benefits of tax cuts on low- and middle-income Georgians and to ensure any final proposal is equitable for all families and would preserve the state’s fiscal health. The deadline for final passage of any legislation is April 4, 2022

Members of the General Assembly are considering a range of proposals that could initiate the most significant changes in the state income tax in a generation through House Bill 1437, which could upend the state’s ability to meet its obligations or offer a path towards modernization and more take-home pay for Georgians. As passed by the House, the bill would shift from taxing personal income under a graduated income tax with rates between 1 to 5.75 percent to a flat tax of 5.25 percent. The bill would also eliminate most personal income tax itemized deductions while preserving those for charitable contributions and would raise the state’s standard exemption to nearly match the federal standard deduction. Although certain provisions of the legislation—such as raising the standard exemption offered to all tax filers and eliminating most itemized deductions for personal income taxes—would offer positive benefits to Georgia families if isolated, the package tilts significantly toward top earners because of the inclusion of a flat tax that increases the legislation’s cost by approximately $645 million annually.

Members of the Senate Finance Committee made significant changes to fundamentally restructure most of the provisions of HB 1437. The legislation would shift to a graduated income tax with rates of 4.99 percent and 5.75 percent for at least eight years, while gradually lifting the amount of income taxed at 4.99 percent through a nine-step process that aims to transition the state to a flat tax on all income by 2032, but only state revenues increase steadily enough to satisfy benchmarks included in the bill. The bill also includes a smaller increase in the personal exemption than the change included in the original House-passed version and a non-refundable state Earned Income Tax Credit (EITC) valued at 10 percent of the federal level. An EITC would reduce income taxes for low to middle-income Georgians. Implementation of the full bill will rely on raising significant revenue to offset increasingly large reductions in income tax collections that would occur as the amount of income taxed at 4.99 percent increases over eight steps. Changes to the film tax credit included in the version of HB 1437 passed by the Senate Finance Committee cap the value of credits at $900 million per year, and, more importantly, make the credit non-transferable and eliminate the ability of companies to profit from the sale of excess credits. These changes could result in a substantial increase in income tax collections. Last year, film tax credits granted by the state totaled $1.2 billion, equivalent to 4 percent of Georgia’s entire FY 2023 budget.

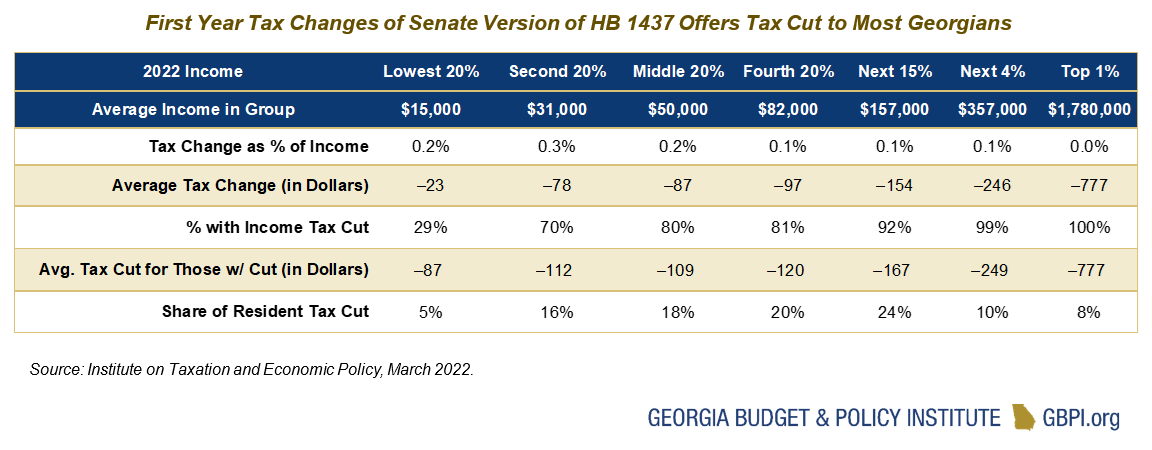

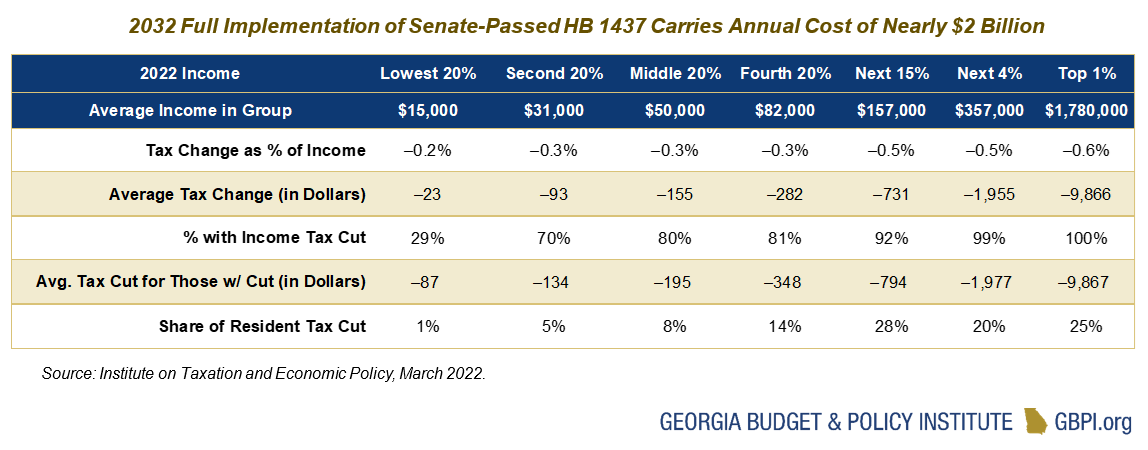

The removal of the provisions related to the film tax credit by the Senate Rules Committee likely renders the bill not viable to implement, as it eliminates the lone provision put forward by the Senate Finance Committee to raise sufficient revenue to help the state to meet the revenue benchmarks set forth. Benchmarks include ensuring that the state’s revenue estimate is increased by at least 3 percent annually. In its first year of implementation, not including potential revenue offsets generated by the now-stripped provisions on the film tax credit, the Senate-passed version of HB 1437 would result in approximately $479 million in net tax cuts. This change is more equitable than the House version. With this change, 58 percent of the benefits would go to the 80 percent of Georgians with the lowest incomes, those earning less than $109,000 per year, compared to the original House-passed version where only 38 percent would go to those same Georgians. Still, the cost would increase dramatically—up to $1.95 billion after its full implementation in 2032. The state would likely not be able to proceed through the prescribed changes to income tax brackets without enacting policies to raise revenues sufficient to avoid the dramatic loss in revenues that would otherwise occur under the bill as passed by the Senate Rules Committee.

Summary of HB 1437 (as passed by the House):[1]

- Most tax savings would be directed to Georgia’s top earners, with 18 percent of all tax cuts going to the top 1 percent (over $575,000 per year), 62 percent going to the top 20 percent (over $109,000 per year) and 81 percent of $1 billion in net tax cuts to the top 40 percent (over $64,000).

- Due to historic and systemic policies that have contributed to lower levels of income and wealth for Black Georgians and people of color, this proposal would worsen racial inequities and expand the racial wealth gap.

- The package is estimated to cause over $1 billion in annual revenue losses, equivalent to over 7 percent of all personal income tax revenues estimated to be raised in FY 2023. This is greater than the amount the state spends on the entire Department of Human Services, Georgia’s ninth-largest state agency, each year.

- The first 60 percent of Georgians earning under $64,000 per year would only stand to gain approximately 19 percent of the legislation’s net benefits, about $193 million. That number is nearly equivalent to the net amount of 18 percent or $179 million that would go to the top 1 percent alone, those making over $575,000 per year, who would see an average tax cut of $4,600 per year.

- The tax changes would become effective for tax years beginning after January 1, 2024.

Summary of HB 1437 (as passed by the Senate):

- Beginning on January 1, 2024, Georgia would shift to a graduated personal income tax comprised of two brackets, taxing income up to $20,000 for married couples filing jointly or $13,000 for single Georgians at 4.99 percent and income above that at 5.70 percent. The threshold of income taxed at 4.99 percent would gradually increase over a period of at least eight years.

- The bill includes three triggers to protect state revenue collections. If any of these are not met, the change in tax rates is delayed by one year.

- (1) The governor’s revenue estimate for the succeeding fiscal year must be 3 percent above the revised revenue estimate for the present year;

- (2) the prior fiscal year’s revenue collection must be higher than each of the preceding five fiscal years, and

- (3) the Revenue Shortfall Reserve must contain a sum that exceeds the amount of the decrease in state revenues projected.

- When revenue meets the above goalposts, the amount of income taxed at 4.99 percent would increase to the following (married filing jointly/single): $35,000/$23,000 in 2025; $55,000/$37,000 in 2026; $75,000/$51,000 in 2027; $99,000/$67,000 in 2028; $149,000/$102,000 in 2029; $225,000/$155,000 in 2030; $500,000/$350,000 in 2031; all income in 2032.

- The legislation adds a non-refundable EITC at 10 percent of the federal level.

- The bill increases the state personal exemption from $7,400 to $11,400 for married taxpayers filing jointly and from $2,700 to $4,700 for single Georgians, while preserving the $3,000 per dependent exemption.

- The legislation would also extend the cap on the state’s double deduction for taxes paid at $10,000.

Lawmakers Should Pursue Opportunities for Equitable Tax Reform

There are opportunities for tax reform in Georgia that would allow the state to increase revenue collections, while simultaneously reducing the amount of taxes owed by many low- to middle-income taxpayers. Members can combine the strongest elements of both the House and Senate versions of HB 1437 to arrive at a more equitable and fair plan to improve Georgia’s tax code. Rather than pursuing a flat tax that primarily benefits the wealthiest, Georgia’s leaders should maintain a graduated income tax, where the tax rate increases as income increases, to allow the state to target the greatest level of tax savings to the low- to middle-income taxpayers, while equitably benefiting all Georgians.

Under the final guidance put forward by the U.S. Department of Treasury for the use of Georgia’s approximately $4.7 billion in flexible state fiscal relief funds, cash assistance is included as an eligible use of these federal funds.[2] Under this provision, the state could finance the costs of implementing a refundable Earned Income Tax Credit to deliver such cash assistance to the sizable group of Georgia families who would be eligible under the federal EITC for at least three years. This would help mitigate the direct costs to the state and jumpstart the administration of a tax credit that has been proven to reduce childhood poverty.[3] A refundable credit valued at 10 percent of the federal level would cost approximately $300 million per year.[4] Even if a non-refundable EITC is enacted, Gov. Kemp could still use his authority over the state’s ARP funds to expand the credit to be fully refundable for the next few years.

Furthermore, adopting an EITC, as 30 states across the nation and the federal government have done, offers the greatest opportunity to put more money in the pockets of low-income families at the lowest net cost.[5] Over 3.5 million Georgians are currently eligible for the federal EITC, including 1.5 million children. Its targeted design also accounts for the number of children in each family. Lawmakers can build on the 10 percent nonrefundable credit included in the Senate version to include refundability. This would allow those eligible to benefit from the full credit they qualify for and therefore add balance to Georgia’s tax structure by reducing the total share of state and local taxes paid by families earning the least.

Enacting the changes included in the House-passed version of HB 1437 to eliminate most itemized deductions in favor of a larger standard exemption would also help to modernize and make Georgia’s income tax fairer. Rather than maintaining a series of itemized deductions that less than 15 percent of Georgians are able to access under current state tax filing guidelines, Georgians would be better served by eliminating these deductions to cover the costs of implementing a larger standard exemption that all filers could claim. Under the House-passed version, this exemption would be nearly equivalent to the federal level and cost approximately $361 million per year. This, however, includes $329 million in costs for maintaining the existing itemized deduction for charitable contributions. Capping the deduction at $20,000 over the standard exemption ($32,000/$44,000) for example would save $233 million, reducing the cost from $361 million to $128 million.[6]

As these consequential and potentially far-reaching proposals advance, lawmakers must above all ensure the state does not jeopardize its long-term ability to meet its obligations and fund core functions such as health care and education. To this end, Fitch Ratings, one of the major bond rating agencies that help to determine the creditworthiness of the state, recently put forward a statement that it views “permanent and immediate cuts as the riskiest to credit” and that “substantial tax policy changes can negatively affect revenues and lead to long-term structural budget challenges, especially when enacted all at once in an uncertain economic environment.”[7]

After the extreme volatility experienced during the pandemic-induced recession of 2020, and now facing high inflation, many state programs and agencies are still reeling from the deep budget cuts implemented, while Georgia struggles to combat an all-time high state employee turnover rate of 23 percent. Simultaneously, the sizable infusion of federal funds that helped to sustain Georgia’s economy during the worst of the COVID-19 pandemic is tapering, adding further uncertainty to the sustainability of revenue collections as basic costs to maintain the status quo in state services are likely to continue to rise.

Finally, although there are aspects of both the House and Senate versions of HB 1437 that would improve Georgia’s tax code—namely eliminating itemized deductions in favor of implementing a larger standard exemption and enacting a state EITC—HB 1437’s flat tax and maintenance of the state’s large itemized deduction for charitable contributions make the bill unnecessarily costly and regressive. As members of the House and Senate work to find common ground in a final bill, lawmakers must reject the flat tax, focus on enacting tax measures that center benefits on the majority of Georgians and prioritize those who need an income boost most rather than spending the state’s limited resources on further enriching top income earners.

Endnotes

[1] Institute on Taxation and Economic Policy, March 2022.

[2] Coronavirus State and Local Fiscal Recovery Funds, 87 Fed Reg. 4362 (January 27, 2022). https://www.govinfo.gov/content/pkg/FR-2022-01-27/pdf/2022-00292.pdf

[3] Kanso, D. (March 5, 2019). Georgia work credit grows the middle class. Georgia Budget & Policy Institute. https://gbpi.org/georgia-work-credit-grows-middle-class/

[4] Department of Audits and Accounts. (January 13, 2021). Fiscal Note for LC 43 1726.

[5] Williams, D. (September 4, 2021). “General Assembly expected to take up state-level Earned Income Tax Credit.” Capitol Beat News Service. https://www.moultrieobserver.com/news/general-assembly-expected-to-take-up-state-level-earned-income-tax-credit/article_fa60310c-0cf9-11ec-ad4e-3fb3e9935a57.html

[6] GBPI Analysis of modeling by the Institute on Taxation and Economic Policy, March 2022.

[7] Fitch Ratings. March 30, 2022. “Implementation Risks Lurk in US State 2022 Tax Cut Plans”. Accessed: https://www.fitchratings.com/research/us-public-finance/implementation-risks-lurk-in-us-state-2022-tax-cut-plans-30-03-2022