Read More of the 2026 Budget Primer here.

The Department of Early Care and Learning FY 2026 Budget

The Department of Early Care and Learning (DECAL) administers: Childcare and Parent Services (CAPS); the Georgia Pre-kindergarten Program; Nutrition Services, which administers the federal Child and Adult Care Food Program; the Summer Meals program for low-income children in daycare facilities; and Quality Initiatives, which works to improve the quality and accessibility of child care programs.

State general funds support CAPS (child care scholarships that helps families with low -incomes), and state lottery funds support the pre-K Program.

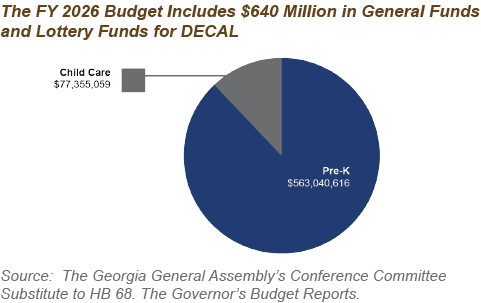

The FY 2026 budget includes $640 million for DECAL, with $77 million going to child care and $563 million to pre-K. This is a 4% increase between FY 2025 and FY 2026.

Even with the 4% budget increase, quality child care is unaffordable for the typical family in most Georgia counties, and it is a greater expense for Black and Latinx families. Meanwhile, the state loses at least $2.52 billion in economic activity annually due to child care challenges, and loses at least $131.7 million in tax revenue. Child care challenges disrupt parents’ workforce participation and reduce earnings, which lowers the family’s purchasing power and tax contributions.

The Pre-K Budget Continues Progress from Last Year; Child Care Needs More Support

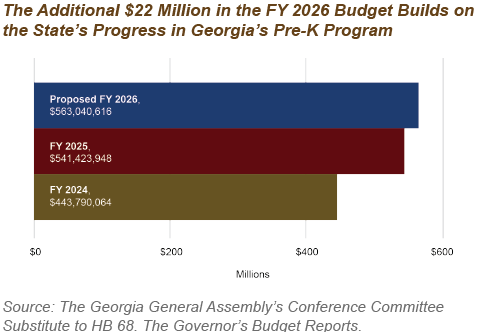

After a historic investment last year, the legislature approved an additional $22 million for pre-K in the FY 2026 budget, including $14 million for year two of the class reduction phase in. Smaller class sizes will allow teachers to give each student more attention.

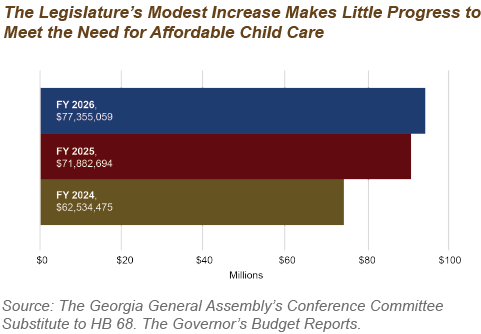

The FY 2026 budget provides a modest increase to the CAPS program. About $1.5 million in the budget will annualize the 60th percentile provider rate reimbursement originally established in the FY 2025 budget. There is also about $4 million for 500 additional CAPS slots.

These modest investments will not close the more than $170 million gap after Congress failed to extend federal funding for child care in 2024. The additional federal funding provided more than 22,000 CAPS scholarships and enhancements to support providers. DECAL is rolling back those expansions with more restrictive policy changes. For example, the agency reduced the initial income eligibility level from 50% of the state median income ($52,947 for a family of four) to 30% of the state median income ($31,768 for a family of four), the lowest in the country. This and other changes aim to reduce the number of children receiving CAPS scholarships.

The Department of Education FY 2026 Budget

- $910 million decrease for Quality Basic Education (QBE) Equalization Grants, which provide additional financial assistance to local school systems that rank below the statewide average of per-pupil tax wealth

- $6 million increase in QBE formula funds for Sparsity Grants to help smaller districts pay fixed overhead costs

- $2.9 billion decrease for Local Five Mill Share (LFMS)— a standard deduction from the total QBE earnings. Local school districts are required to cover at least LFMS in property taxes

- $20 million increase to replace 227 school buses

- $15 million one-time pilot funds to school districts for economically disadvantaged students; previously Georgia was only 1 of 6 states that did not provide support for students living in poverty

- $50 million for student support services, including mental health grants to help with counselor referrals and funds that help ensure that all schools, regardless of size, can have a social worker

Public Funds for Private Institutions

Vouchers defund public schools in two ways. First, they use state public education funds for private institutions. Second, they decrease public school enrollment. This results in a decrease in funding to school districts because state dollars for public schools are based on enrollment. This year, the Georgia General Assembly budgeted $141 million in public funds for the state’s latest voucher program, the Georgia Promise Scholarship (GPS). These funds help eligible students and families pay for private school tuition through $6,500 vouchers. In the first three weeks, the Georgia Student Finance Commission received over 7,400 applications and will potentially fund over 21,000 vouchers to eligible students. There are over 1.7 million students in the state of Georgia.

The GPS is one of three voucher programs and diverts 1% of QBE funds ($141 million) to private schools. Vouchers like GPS make it difficult for schools to handle more fixed costs (operation and maintenance, interest on debt, payments to state and local governments), as school enrollments decline. In 2008-2021, a total of $1.3 billion was diverted by Georgia’s voucher programs even while Georgia underfunded the QBE formula during 2003-2018.

The impact of vouchers can also be roughly measured through “fiscal externality,” a measure of how much per pupil funds are reduced because of an enrollment drop. In the first year of GPS, assuming that about 20% of students who obtain a GPS voucher are public school students who leave to attend private schools, school districts will have to spend between $12 and $61 more per each student who remains to continue to maintain the same level of services, like classroom instruction, that public school students received before voucher students left. Averaged across all Georgia students, the GPS could cost $30 more per student to maintain the same level of services.

Tax Caps Limit School Funding

In Georgia, local boards of education are authorized to impose a tax of at least five dollars on every $1,000 of taxable property value. This is known Local Five Mill Share — and is the required local effort to support local public schools. Local property taxes account for approximately 37% of total public school funding in Georgia in FY 2022. That funding will likely be reduced by a recent statewide property tax policy, HB 581, that caps the annual assessment increase for property taxes at the rate of inflation. For example, if inflation is 2%, the maximum increase in a home’s assessed value would also be 2%. In Georgia, homeowners pay property taxes based on their home’s value, which is determined by their county assessor. School districts can opt out of this property tax cap which would allow districts leaders to have more flexibility and local control to levy additional taxes for public school funding. Many large school districts have opted out, as of March 1, approximately 120 school systems have taken this action. After the passage of HB 92, school districts will have until March 1, 2030, to confirm their decision to cap property taxes.

The University System of Georgia/Board of Regents FY 2026 Budget

Georgia’s four-year public higher education system, the University System of Georgia (USG), is composed of 26 higher education institutions located across the state. USG also encompasses the Georgia Public Library Service, which manages 61 libraries; and the Georgia Archives, which collects and preserves records and information about Georgia.

The overall FY 2026 is $10.2 billion and contains $2 billion in federal funding. The state portion of the USG budget is $3.6 billion, up from $3.4 billion in FY 2025. State general funds of $3.3 billion were allocated to USG’s 26 colleges and universities for student instruction and support services like academic advisement. This FY 2026 allocation to USG’s 26 institutions increased by 7% from FY 2025.

FY 2026 USG Teaching Budget highlights:

$170 million increase for a 2.7% growth in enrollment and a corresponding increase in campus square footage

$11 million increase for the employer contribution rate to the Teachers Retirement System (TRS) moving from 20.78% to 21.91%

$19 million increase for the employers’ share of health benefits

Tuition and Fee Rate Updates

The USG uses an appropriation funding formula that is designed to compute funds needed to cover the costs of educating students. The formula is primarily based on student enrollment.

Georgia ranks third lowest in the south and sixth lowest in the nation for average tuition and fees. This year the USG in-state tuition rates in the 2025-26 academic year are set to remain flat for most institutions, although out-of-state tuition will increase by 2%, and out-of-country tuition is set to rise by 3%.

University System of Georgia’s Lack of Investment in Public Higher Education

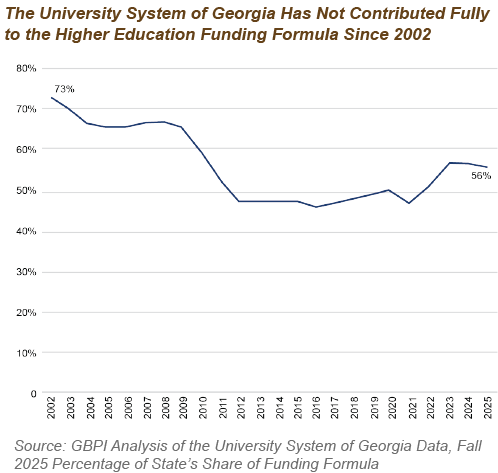

Since 2002, the USG has failed to pay its original share (75%) of the state USG budget under the public higher education funding formula. In FY 2025, the Georgia state appropriation was 19% less, totaling only 56% of the state USG budget. This means that students must support the remainder, or 44%, through their tuition and fees.

Georgia’s continuing disinvestment in public higher education reflects national trends of decreasing state spending per student, even while enrollment nationally has increased over the last 25 years. State investment helps mitigate financial barriers, reduce student loan debt and increase postsecondary degree attainment. State appropriations also decrease time to degree among students at four-year colleges and boost the transfer rate of two-year college students to four-year institutions.

The Technical College System of Georgia FY 2026 Budget

The Technical College System of Georgia (TCSG) includes 22 colleges and 88 campuses providing technical and core academic education.

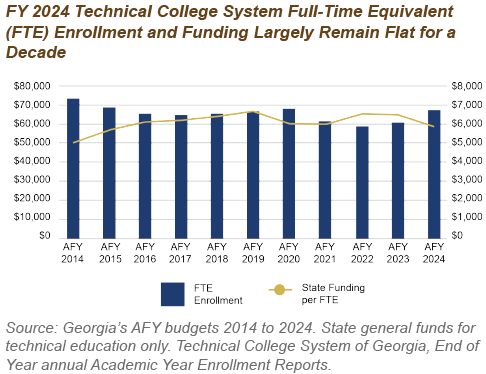

The FY 2026 budget for TCSG is $538 million. Approximately $444 million has been reserved for technical education, which provides funding for continuing education or training for youth and adult learners and helps support workforce development. The rest of the budget has been allocated for Adult Education programs that cater to individuals without a high school diploma, and business initiatives that encourage job creation.

FY 2026 Technical Education Budget highlights:

- $331,885 increase to reflect the Teachers Retirement System (TRS) employer contribution rate increase from 20.78% to 21.91.7%

- $33 million increase to reflect a 10.6% enrollment increase (last year, $9 million was added to reflect a 3% increase in enrollment)

Education Lottery Reserves

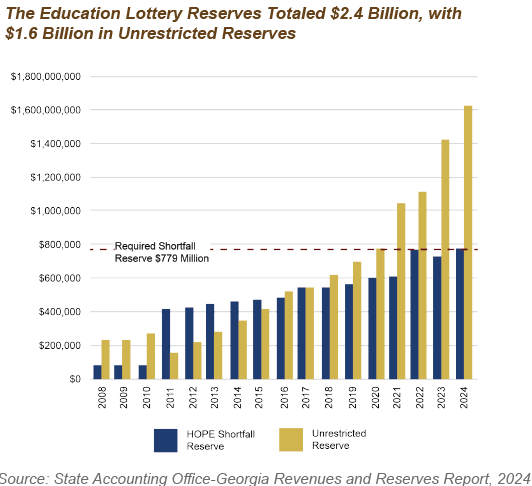

The Lottery for Education account is required to maintain a minimum balance, called the shortfall reserve, of 50% of the previous year’s net lottery proceeds. If lottery ticket sales underperform, the state can draw on this reserve to fund the Helping Outstanding Pupils Educational (HOPE) scholarship program. Once the 50% level is reached, additional reserves are unrestricted. In FY2024, total education lottery reserves were $2.4 billion, with a $779 million required shortfall reserve and $1.6 billion in unrestricted reserves.

The College Completion Grants Program

The College Completion Grants are micro-grants awarded to students who qualify for financial support to finish their post-secondary education. Four-year and two-year college students who are Georgia residents and completed at least 80% of their degree program could receive up to $2,500 in College Completion Grants. In the 2025 Legislative Session, House Bill 38 passed to decrease the degree completion threshold from 80% to 70% for four-year programs and from 80% to 45% for two-year programs which will expand access to College Completion Grants to more students. HB 38 also extends the College Completion policy sunset year from 2025 to 2029. The College Completion Grants budget remains flat at $10 million for FY 2025.

Across the state of Georgia, 78 eligible Georgia post-secondary institutions received College Completion Grants funds.