The $25 billion state budget proposed by Gov. Nathan Deal for the 2018 fiscal year starting July 1, 2017 lays out his desired roadmap for Georgia to fund the people’s business over the coming year. It represents a $1.26 billion increase in total state spending over the 2017 budget approved last year, an increase of 5.3 percent. While the proposed budget represents a high water mark for Georgia in absolute dollar terms, it only returns per-capita state spending to just below pre-recession levels.

The proposed 2018 budget includes some worthwhile investments, including sizable salary raises for state troopers and child welfare workers to help with recruitment and retention, as well as program enhancements to improve child care assistance. At the same time, most of the new revenue is consumed by the naturally rising needs of a growing state. About 80 percent of the $1.3 billion in new spending maintains the status quo, including increased student enrollment, growing pension and health care costs and an overdue 2 percent cost-of-living adjustment for K-12 public school teachers.

The 2018 budget also includes money from a critical revenue source that is up for renewal. The governor’s proposal assumes lawmakers will reauthorize Georgia’s hospital provider fee, which brings in about $311 million in state funds that can leverage an additional $600 million in federal funds. If the fee is not renewed, lawmakers will face a roughly $900 million shortfall in health care spending through the Medicaid budget.

Amended 2017 Fiscal Year Budget

Each January the governor proposes two distinct budgets – one that lays out a new spending plan for the fiscal year starting the following July, and another that amends spending levels for the current fiscal year to reflect actual tax collections and rising spending needs over the course of year.

2017 Revenue Revision

The governor’s amended 2017 budget increases state spending by $606 million, or 2.6 percent, more than the original 2017 budget passed last year. More than $222 million is added in the 2017 amended budget from the Mid-Year Adjustment for Education, which funds growing K-12 student enrollment. Another $384 million comes from an increase in the revenue estimate due to stronger 2016 revenue collections than originally projected.

Revenues for the remainder of the 2017 fiscal year that ends June 30 need to grow by 3 percent to meet the budget. Revenue collections by the Georgia Department of Revenue for the first six months of the fiscal year show revenue growth of 4 percent. However, December 2016 collections were only 0.7 percent more than the prior year. If the state treasury realizes another couple of months of depressed revenue growth, Georgia could run the risk of ending the 2017 fiscal year with a slight shortfall. This is an important trend for lawmakers to monitor.

2017 Spending Changes

The amended 2017 budget includes $606 million in new spending compared to the budget lawmakers sent to the governor’s desk last year. The size of new enhancements proposed in the amended 2017 budget, such as raises for state troopers, is somewhat unusual. After accounting for the surge of new money available in the amended 2016 budget due to a transportation tax package passed the year before, the increase in the amended 2017 spending plan is $200 million to $400 million greater than any amended budget from the past six years. It is widely accepted best practices in budgeting for additional funding in the amended budget to go towards funding mid-year budget shortfalls, emergency situations or one-time expenditures. It is a better budget practice to fund new initiatives or the expansion of existing initiatives that have an out-year budget impact at the beginning of a fiscal year. Highlights of the 2017 amended budget include:

- $111.2 million in the midterm adjustment to fund student enrollment growth in public K-12 schools and state charter schools

- $108.7 million for the Department of Transportation from new state general and motor fuel funds resulting from a transportation tax package passed in the 2015 session

- $50 million for the One Georgia Authority for the creation of a new Cyber Security Range

- $41.5 million to increase funds for economic development projects through the OneGeorgia and the Regional Economic Business Assistance programs

- $36.5 million to the Department of Corrections to implement an Electronic Health Records contract and to address rising costs of pharmaceuticals for the inmate population

- $28.6 million for child welfare services after an increase of children in state custody

- $27.2 million to provide a 20 percent salary increase for state law enforcement officers and salary increases for public safety trainers and criminal investigators to reduce turnover and improve recruitment

- $26.9 million in one-time spending for public safety agencies, the Georgia Department of Natural Resources and state Department of Agriculture to replace various vehicles

- $16.8 million for growth in the Move on When Ready dual enrollment program

Fiscal Year 2018 Budget Proposal

The governor’s 2018 budget proposal contains nearly $1.3 billion in new general fund spending compared to 2017. About $1 billion is due to revenues exceeding the 2017 budget passed by lawmakers last year. Another $292 million is from savings found within the budget. Of that total, $109.8 million comes from refinancing bonds at a lower interest rate, $73.1 million from the recognition of the local portion of the Quality Basic Education Local Five Mill Share, $50.4 million from a lower state Medicaid match, $47.2 million in other savings in the Medicaid program and $11.5 million in savings from the Board of Regents.

Despite the new money, the proposed 2018 budget is slightly less than the last budget passed before the recession when adjusted for economic changes and the rising needs of a growing state. Factoring in an 8 percent increase in population and 12 percent inflation, the $2,424 per capita state spending in the 2018 budget is $71 less than the $2,495 equivalent in the 2009 budget. The 2018 budget would include about an extra $732 million if per capita spending were equal to the 2009 budget levels.

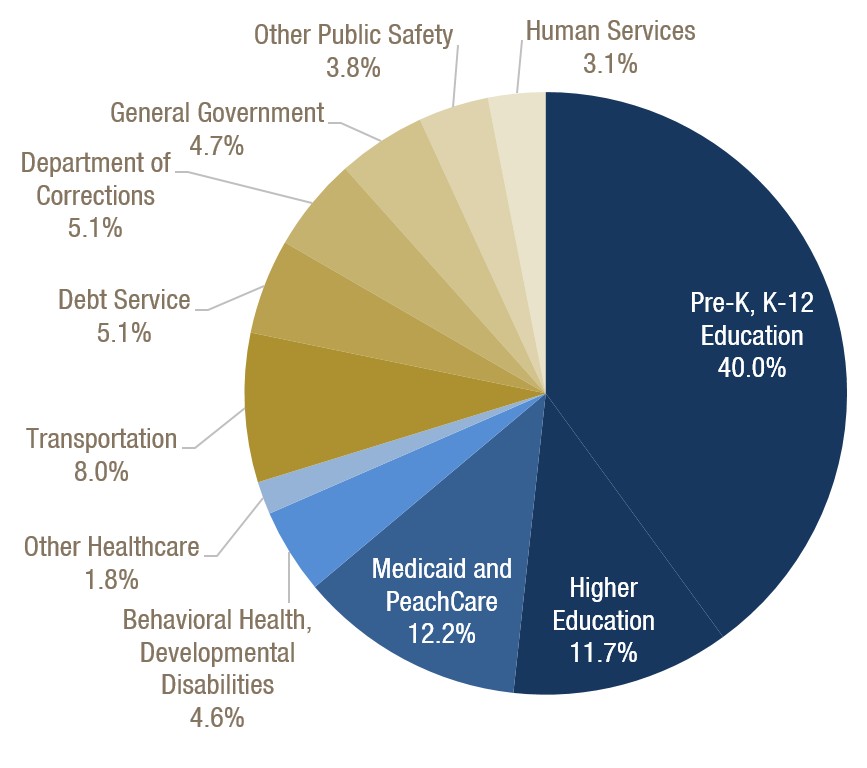

Education spending continues to dominate the state budget, accounting for 51.7 percent of Georgia’s general revenue funds. Nonetheless, the K-12 funding formula still contains a $166 million austerity cut. Medicaid is the next largest state expense, accounting for 12.2 percent of state general revenue. On a per-enrollee basis, Georgia spends the second-lowest amount on Medicaid among the states. Over 95 percent of general fund revenues are allocated to education, health care, public safety, human services, transportation and debt service, as shown in the accompanying chart.

Education and Health Care More than Two-Thirds of State Budget

2018 Fiscal Year State General Fund and Motor Fuel Funds Budget

About $1.02 billion, or 80 percent, of the $1.3 billion in new spending pay for the ongoing expenses of a growing state with an increased demand for existing services and the normal business costs of state government. The following table shows the top expenses attributable to natural growth and the top new discretionary expenses.

About $1.02 billion, or 80 percent, of the $1.3 billion in new spending pay for the ongoing expenses of a growing state with an increased demand for existing services and the normal business costs of state government. The following table shows the top expenses attributable to natural growth and the top new discretionary expenses.

Most of the $1.3 Billion in New Spending Attributed to Natural Growth

Largest spending line items, by category, 2018 fiscal year

| Natural Growth, Status Quo | Millions | Strategic Funding Additions | Millions |

| Teachers, State employee COLA | $279.5 | Debt Service on New Bonds | $105.8 |

| Teachers Retirement System | $221.8 | 20% Raise for state troopers | $55.4 |

| K-12 enrollment growth | $133.3 | 19% Raise for child welfare workers | $25.9 |

| K-12 equalization grant | $85.9 | Northwest Corridor I-75 Expansion | $10.0 |

| University enrollment growth | $70.1 | Metro Re-Entry Prison | $6.3 |

| Replace State Funds for Motor Fuel | $36.6 | Mental Health Crisis Center | $6.0 |

| Growth in Out of Home care for foster children | $30.9 | Add child welfare staff | $5.4 |

Source: GBPI analysis of Governor’s proposed budget for FY 2018

Notable 2018 changes in GBPI’s focus areas of education, health care and human services include:

K-12 Education

- $160 million for a 2 percent salary increase for authorized teachers

- $133 million for expected enrollment growth and routine increases in teacher salaries based on years of experience and training

- $177 million for an increase in the employer share of retirement costs

- $85.9 million for the Equalization Program, which provides grant to districts with low-property wealth

- Nearly $30 million for an increase in monthly costs of health insurance for bus drivers and non-teaching staff

- $29.4 million for Move On When Ready to keep pace with anticipated enrollment growth

Higher Education

- $70 million for increased enrollment and square footage in the university system

- $40 million for merit pay raises for university employees

- $34.7 million for an increase in the employer share of university employee retirement costs

- $5.4 million for merit pay raises in the technical college system

Health Care

- A decrease of $85.7 million in Medicaid state funds due to an increased federal share and additional funds from a legal settlement with Tenet Healthcare

- $21.9 million to expand autism services for children under 21 in Medicaid and the state health plan

- $19.3 million to annualize the cost of 350 New Options (NOW) and Comprehensive Supports (COMP) waiver slots in addition to 250 new NOW and COMP waiver slots

- $17.9 million to increase Medicaid reimbursement rates for select primary care and OB/GYN providers to 100 percent of 2014 Medicare levels

- $11.7 million for COMP provider rate increase, which is awaiting federal approval

Human Services

- $31 million to address a rise in the number of children needing foster care

- $26 million included in the governor’s 2018 budget proposal for a 19 percent increase in the salaries of child welfare workers

- $11 million for a new Integrated Eligibility System

- $5.4 million to add 107 additional child welfare workers

- $4.2 million for additional senior services, including Meals on Wheels

Salary Adjustments

The 2018 budget includes $360.8 million for salary increases for teachers and state employees. Raises for K-12 teachers and state employees are essentially cost of living adjustments, which as general practice should be included in most yearly budgets. Larger raises for state troopers and child welfare workers represent more sizable, one-time increases designed to improve employee retention. Notable salary changes and budget costs are:

- $160.1 million for 2 percent increase in Quality Basic Education program to base salary schedule for certified personnel, school bus drivers and school nurses

- $68.4 million for merit based pay increases for high performing employees of the Executive, Judicial, and Legislative Branches or for salary adjustments to attract and retain new employees with critical job skills

- $55.4 million for 20 percent raise for law enforcement personnel and adjustment for some criminal investigators

- $43 million for performance incentives or salary adjustments within the Board of Regents

- $27.8 million for salary adjustments for certain identified job classifications with the Department of Defense, Department of Human Services and Department of Public Health

- $6 million for performance incentives or salary adjustments in the Technical College System for teachers and support personnel

Bond Projects

The 2018 budget includes authorization to sell $1.05 billion in bonds for new projects, a somewhat larger bond package than proposed in recent years. The additional debt service for these bonds is $105.8 million. The state sells bonds to pay for capital improvements, such as construction of new buildings. Bond projects include renovations and equipment in K-12 schools, university and technical college system, construction and renovations to state buildings, as well as construction and maintenance of roads and bridges. Notable bond projects in the 2018 budget include:

- $248.4 million for K-12 schools including $240.9 million for Capital Outlay Program and $7.5 million for the purchase of new buses

- $208.3 million for the University System of Georgia, including large construction projects at the Georgia Institute of Technology, Armstrong State University and the University of Georgia

- $115.9 million for the Technical College System of Georgia, including $73 million construction and equipment of a new Hall County campus to replace the Oakwood campus at Lanier Technical College

- $105 million for construction of a new Judicial Complex Building in Atlanta

- $100 million for repair, replacement and renovation of bridges, statewide

Reserves

Georgia’s Revenue Shortfall Reserve, or rainy day fund, stands at $2 billion in January 2017, or 9.1 percent of 2016 general fund revenues. Current reserves are enough to operate the state for 31 days. The reserve fund builds at the end of each fiscal year if there is surplus state revenue. A healthy reserve cushion is needed to maintain important state functions during economic downturns that sap state revenue. Prior to the Great Recession, the reserves grew to $1.5 billion, or enough to operate the state for about 30 days. The state tapped these reserves to help balance budgets in 2008, 2009 and 2010. Even with such substantial reserves, lawmakers cut many important state programs during and after the recession. Many of the programs cut are still not restored to pre-recession funding levels.

Rainy Day Fund Tops $2 Billion Goal

Georgia Revenue Shortfall Reserve, in billions