Introduction

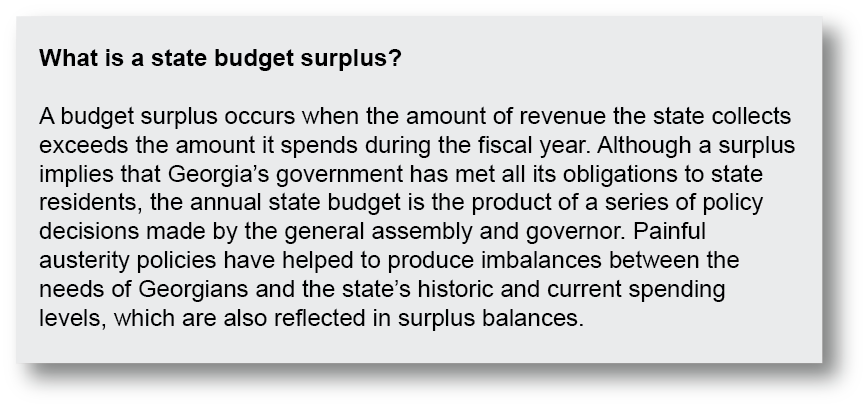

After two consecutive years of record budget surpluses—generated in part by persistent austerity—Gov. Brian P. Kemp’s proposed $32.5 billion budget for Fiscal Year (FY) 2024 offers a muted response to deep deficits in the capacity of state government to meet Georgians’ needs. The governor forecasts a sharp drop in tax collections from FY 2022 to 2023, and a relatively flat budget in 2024. Instead of utilizing state surpluses to address major gaps in core functions like public education and health care, Gov. Kemp’s amended fiscal year (AFY) 2023 budget directs only a fraction of these funds toward modest, one-time rebates, while preserving most surplus funds in state accounts.

The AFY 2023 and FY 2024 executive budget proposals make positive strides in areas like increasing funding for the HOPE scholarship to cover full tuition costs and make cost-of-living pay adjustments. However, other issues demand urgent attention and greater resources. Key issues facing lawmakers as the General Assembly considers the budget, include:

- Record-high state employee turnover that now exceeds 29 percent among full-time agency staff;

- A looming 67 percent spike in the cost of providing coverage through the State Health Benefit Plan that threatens to saddle local school districts with hundreds of millions in unexpected costs;

- Processing Medicaid eligibility redeterminations for more than 2.6 million Georgians that are likely to result in the loss of coverage for hundreds of thousands;

- Billions in federal funds left on the table due to the state’s refusal to fully expand Medicaid to cover the approximately 500,000 eligible Georgians, as the state seeks to move forward with its Georgia Pathways proposal for a scaled-down Medicaid waiver with work requirements.

Each January, the governor proposes two distinct budgets: (1) The amended budget for the current fiscal year (FY 2023) that adjusts spending levels for the current fiscal year that ends June 30th to reflect actual tax collections, enrollment growth and any spending changes over the remaining months of the year and (2) the full budget for the next fiscal year (FY 2024) that lays out a new spending plan for the next fiscal year starting July 1, 2023. Under Georgia law, the governor maintains unilateral authority to set the revenue estimate—which effectively acts to cap spending—and the 236 members of the state’s General Assembly hold authority over appropriating funds and are constitutionally obligated to pass an annual state budget.

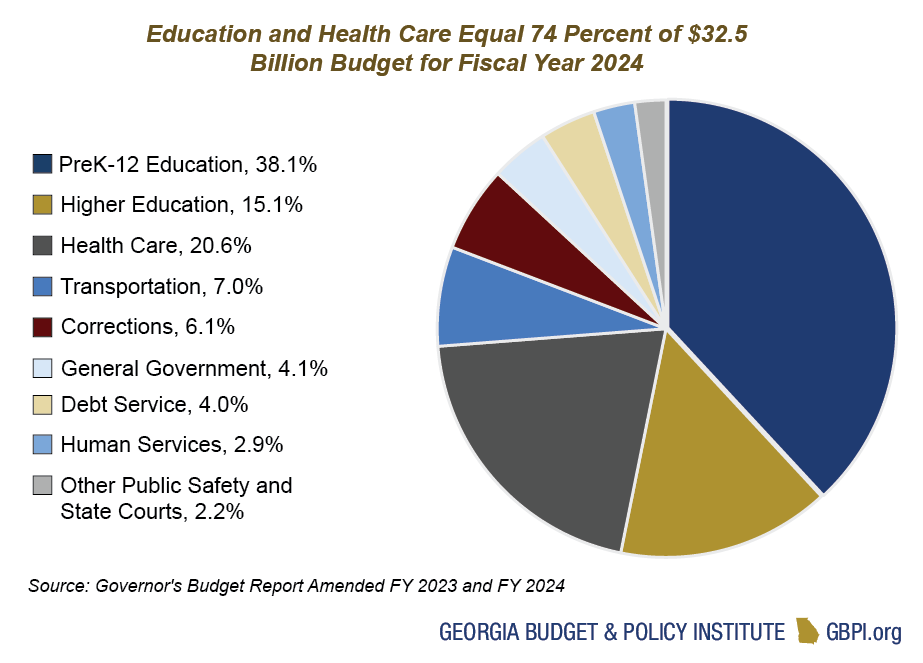

Gov. Kemp’s executive budget proposal for fiscal year 2024 is built on moderate growth of about $2.4 billion in appropriations (or a 7.5 percent increase from original FY 2023 budget –levels). Resources are primarily added to the FY 2024 executive budget proposal to finance increased costs necessary to maintain the status quo of state government, and to meet a limited set of priorities put forward by Gov. Kemp. In fact, Georgia’s FY 2024 spending plan remains on track to fall approximately $432 million below FY 2008 levels when adjusted for population growth and inflation.[1]

As such, between 2008 and 2022, the state’s workforce dropped from 83,000 full-time employees to less than 60,000, even as Georgia’s population grew by more than one million residents.[2] By the conclusion of FY 2022, turnover across all state agencies reached an all-time high in excess of 25 percent and greater than 29 percent among full-time employees, while the number of applicants for state positions fell to an all-time low.[3]

To address this issue, Gov. Kemp recommends adding $567 million in statewide appropriations to provide a $2,000, across-the-board cost-of-living adjustment for state and Regents employees, Pre-K teachers and assistant teachers, and certified K-12 employees. Although this adjustment is greatly needed and comes on top of a $5,000 cost-of-living adjustments added in FY 2022, under the FY 2024 executive budget, most individual agencies are told to maintain relatively flat spending levels. The proposed increase would likely raise the median starting salary for the executive branch employees to approximately $36,000 and lift the workforce-wide median to just below $47,000 per year.[4] As the general assembly considers the proposed budget, legislators must consider the depth of need facing each agency and appropriately make broader personnel and staffing adjustments to allow individual agencies to meet the needs of Georgians more efficiently and effectively.

Budget Proposal Raises Serious Questions Over Major Spike in State Health Benefit Plan Costs for Schools

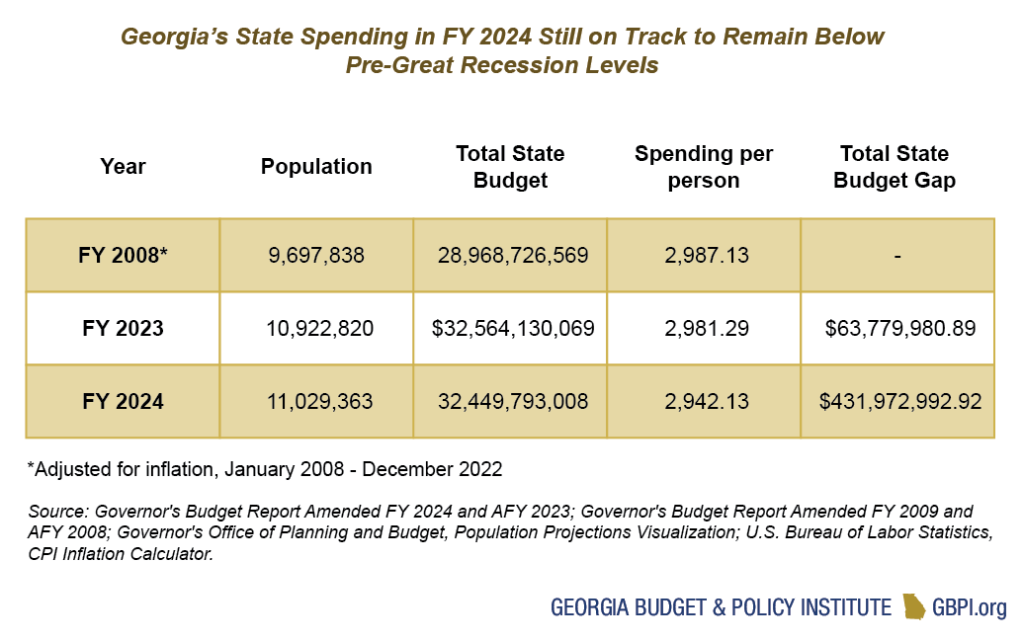

When Gov. Kemp released his executive budget, school districts across Georgia were alerted to a costly surprise: the price of providing health care through the State Health Benefit Plan (SHBP) will increase by 67 percent, with the required employer contribution going up by $7,200 per year for each employee, or by $635 per member, per month from $945 to $1,580. Although Gov. Kemp’s budget includes $847 million in FY 2024—enough to cover increased costs for about 111,000 certified educators—GBPI estimates that, in total, approximately 209,000 school employees may be impacted statewide. This leaves a gap of $745 million that is currently unfunded by the state. If this gap remains unfilled as presented in the executive budget, local school districts across the state would be left to cover the brunt of increased costs in January of 2024.

At the same time that school districts face pressure to cover increased health insurance costs for their employees, Gov. Kemp’s AFY 2023 budget proposes allocating $1.1 billion to finance a one-time property tax credit of $20,000. This tax credit would only apply to the assessed home value of primary residences.

As the governor seeks to reassert the state into property tax matters for the first time since the statewide property tax was eliminated in 2016, Georgia is also putting pressure on school districts to raise nearly $745 million with little warning. This short-sighted decision reflects a broader pattern in recent years to shift increased public education costs to the local level while simultaneously adding pressure on local governments and authorities to raise sufficient revenue to meet increased responsibilities. For example, between 1991 and 2022, the state’s spending on K-12 transportation costs fell from 54 percent of all costs to just 20 percent, forcing districts to pay the lion’s share of nearly $1.1 billion in statewide costs last year.[5]

The state also maintains an array of exemptions and tax credits, along with pre-emption laws, that affect local tax bases and limit the kinds of revenue sources that cities and counties are authorized to enact. As the state’s Quality Basic Education formula for public schools has been persistently underfunded over much of the last decade, Georgia remains one of six states that does not account for poverty levels when allocating funds to schools.[6] If these issues remain unaddressed, school districts with low incomes and low wealth are likely to face the greatest financial pressures, furthering disparities across income and harming Black and Brown families most.

State Medicaid Program to Begin Historic Unwinding Process

Due to federal changes made in response to the COVID-19 Pandemic—between 2020 and 2022—enrollment rates for Georgia’s Medicaid program grew by approximately 41 percent, offering hundreds of thousands of residents access to health coverage.[7] Over the next year, Georgia’s federal match for Medicaid costs is expected to return to a more historically-normal level that will see it decrease from 72 percent to 66 percent, while the state undertakes the massive task of redetermining eligibility for the program’s more than 2.6 million enrollees over approximately 14 months.[8]

Processing these redeterminations will put tremendous pressure on Georgia’s health agencies, which already face serious challenges in hiring and retaining existing staff to meet core agency functions. Gov. Kemp’s AFY 2023 budget proposes allocating $6.5 million to the Department of Human services to hire additional caseworkers and staff and $3.2 million for the same purpose in FY 2024. Through the Medicaid unwinding process, an estimated 545,000 Georgians could lose health insurance coverage.[9] Without further action from state leaders, the number of uninsured Georgians could surge back to pre-pandemic levels of around 16 percent of the state’s non-elderly population.[10]

Funding Allocated for Costly Medicaid Waiver Plan, Medicaid Expansion Remains Best Value

Under the 2019 Patients First Act (Senate Bill 106), the state authorized the Department of Community Health to pursue an 1115 Medicaid waiver—called Georgia Pathways—to cover those earning up to 100 percent of the Federal Poverty Level (FPL). The program, however, requires enrollees to meet prescribed work and premium requirements. Gov. Kemp includes $52.2 million in the FY 2024 executive budget to implement this limited expansion of Medicaid enrollment, beginning July 1, 2023. In 2021, $65 million in funding was allocated for the same purpose that is recognized in the executive budget proposal.

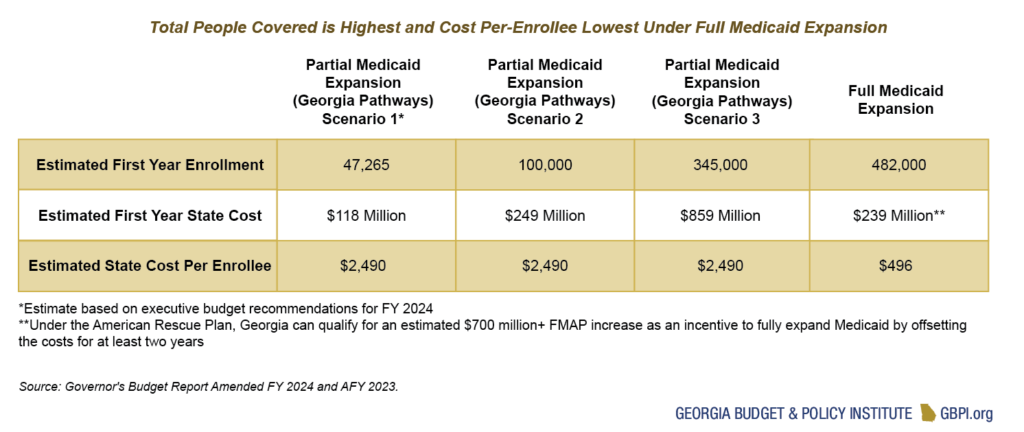

Because the enhanced 90 percent match for Medicaid expansion under the Affordable Care Act is limited to states that fully expand eligibility up to 138 percent of the federal poverty level (FPL), enrollees in Georgia added under Gov. Kemp’s program would only qualify for the standard federal match of 66percent. On a per-enrollee basis, that means Georgia would pay an estimated first-year cost of $2,490 per enrollee, compared to an estimated cost of $496 under full Medicaid expansion.

Although the number of eligible Medicaid enrollees under the state’s Georgia Pathways plan depends on recipients meeting reporting and premium requirements, state projections estimate enrollment between 52,000 and 64,000. This estimate is based on a larger pool of approximately 345,000 Georgians earning less than 100 percent of the FPL.

In contrast, full Medicaid expansion would cover an estimated 482,000 enrollees at a projected first-year cost of $239 million. Additional incentives created under the American Rescue Plan of 2021 would provide an enhanced federal matching rate of five percent on all existing Medicaid enrollees for the first two years after full Medicaid expansion, lifting the share of costs paid with federal dollars up from approximately 66 to 71 percent. This incentive is in addition to the permanent 90 percent federal match for newly eligible enrollees and would more than offset the state costs of expansion for at least the first two years.[11]

After Pandemic Rebound, Governor’s Revenue Estimate Keeps Spending Flat in FY 2024

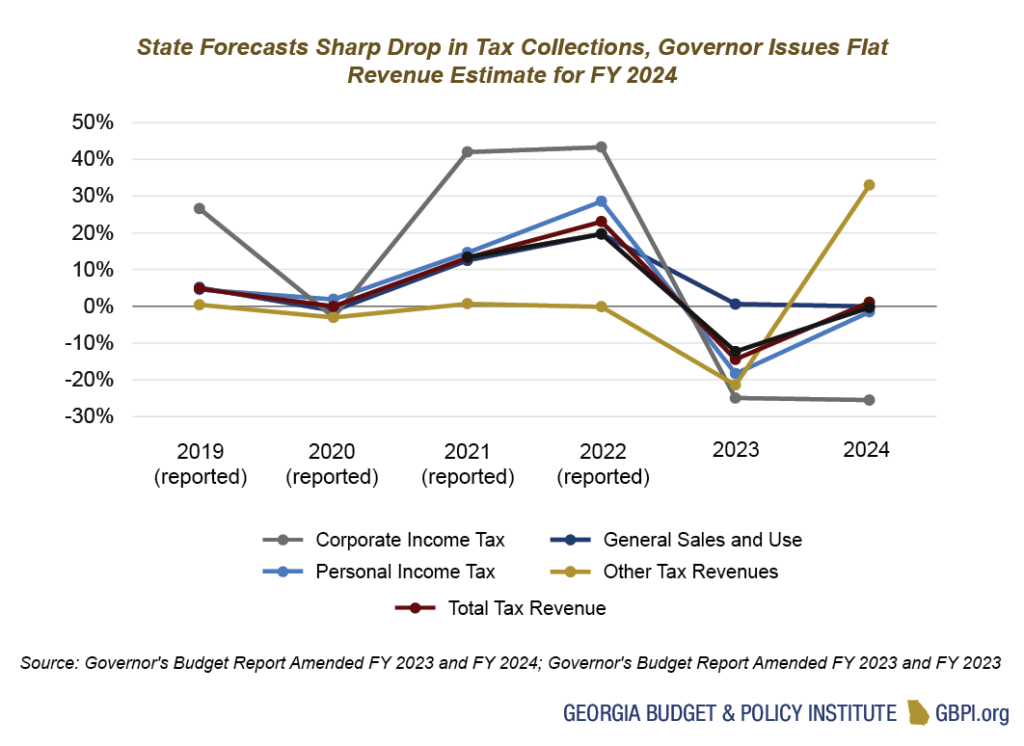

Following historic growth in state revenue collections in FY 2021 and 2022, Gov. Kemp’s revenue estimate projects a sharp decrease in tax collections in FY 2023 and for most revenue sources to remain flat in FY 2024.

As a matter of public policy, when evaluating Georgia’s revenue trajectory and estimates issued by the governor, it is also important to consider underlying economic conditions that are likely to shape state revenues. University of Georgia economic forecasters project that inflation will moderate to about three percent by mid-2023, whereas personal income will rise slightly above inflation at four percent in 2023 and personal income expenditures are expected to increase by approximately two percent.[12] Overall, Georgia’s inflation-adjusted GDP is expected to rise by 0.2 percent, outperforming the national U.S. economy’s anticipated decline of 0.2 percent.[13] Taken together, despite the strong likelihood of a mild economic recession nationally, Georgia’s economy is expected to maintain steady performance in the year ahead.

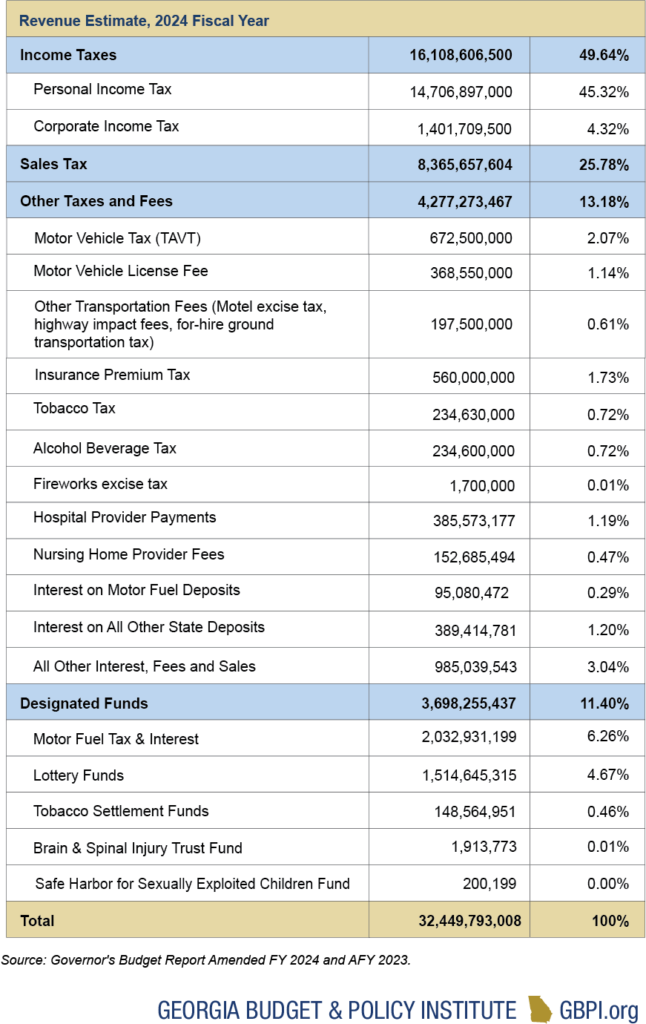

With state revenues generated primarily through income taxes, Gov. Kemp projects personal income tax collections to fall over 18 percent in 2023, followed by a further 1.5 percent drop in 2024. As explained by the state economist, Dr. Jeffery Dorfman, falling stock valuations and reduced capital gains claimed on 2022 income tax returns could yield a “$3 billion drop from last year” in collections.[14] The governor also forecasts a steep fall in corporate income collections, estimating a decline of 25 percent in 2023, followed by another sharp dive of nearly 26 percent in 2024, down to just $1.4 billion from the $2.5 billion reported in 2022.

In contrast, sales and use tax revenues, representing about 26 percent of the state budget, are projected to increase modestly by about one percent in 2023 and then remain flat in 2024. Across the remainder of the state’s revenue categories, Gov. Kemp generally maintains a conservative outlook for a relatively stagnant 2023 and 2024. However, one notable exception is revenues collected on interest from state deposits. From 2022 to 2023, interest on state deposits is expected to increase from $46 million to $478 million, before dipping slightly to $389 million in FY 2024, well above the state’s historical average. Separately, on motor fuel deposits, interest revenue is expected to grow from $15 million in 2022 to $95 million in both 2023 and 2024.

Overall, the governor projects total state revenues to fall by $4.4 billion from 2022 to 2023, a decline of 12 percent, and to remain relatively stagnant, with a growth rate of less than one percent in 2024. Projected linearly, from 2021 to 2024, state revenues would grow by an average of 2.3 percent per year under the estimates issued by the governor, placing spending levels well below the average inflation rate. In other words, the state is on track to lose ground in meeting the needs of Georgians against inflation, while it simultaneously accrues increasingly large balances in reserve accounts from end-of-year surpluses.

So far, through the first six months of FY 2023, reported year-over-year tax collections have increased by 6.5 percent, or about $967 million, from the same period in FY 2022, with personal income taxes up 8.6 percent, corporate income tax collections up 83.8 percent, and sales and use tax collections up 11.5 percent.[15] It is also important to note that no motor fuel tax collections were collected during the first half of the year, with the state gas tax suspended from July 1 through January 10, 2023.

With the state set to begin implementing the flat tax legislation (HB 1437) in January of 2024, Georgia’s low projections for state revenue collections could threaten delays in the measure’s seven-year implementation schedule. The legislation is designed to shift the state’s current income graduated tax brackets of 1 to 5.75 percent to a flat tax of 5.49 percent in 2024, and then to methodically lower that rate to 4.99 percent, while simultaneously increasing the state’s personal exemption from $18,500 in 2024 to $24,000 in 2030.

However, three conditions must be met for the annual steps to proceed on time between 2024 and 2030.[16] First, the governor’s revenue estimate for the succeeding fiscal year must be at least three percent above the governor’s revenue estimate for the current fiscal year. Second, the prior fiscal year’s revenue collection must be higher than the preceding five fiscal years’ net tax revenue collection. Finally, the Revenue Shortfall Reserve balance must contain sufficient funds to cover the projected decrease in revenue from the pending tax changes. Under the current revenue estimate and fiscal outlook issued by Gov. Kemp, it is not clear that all these conditions would be met to allow the measure to be fully implemented by 2030, as prescribed by HB 1437.

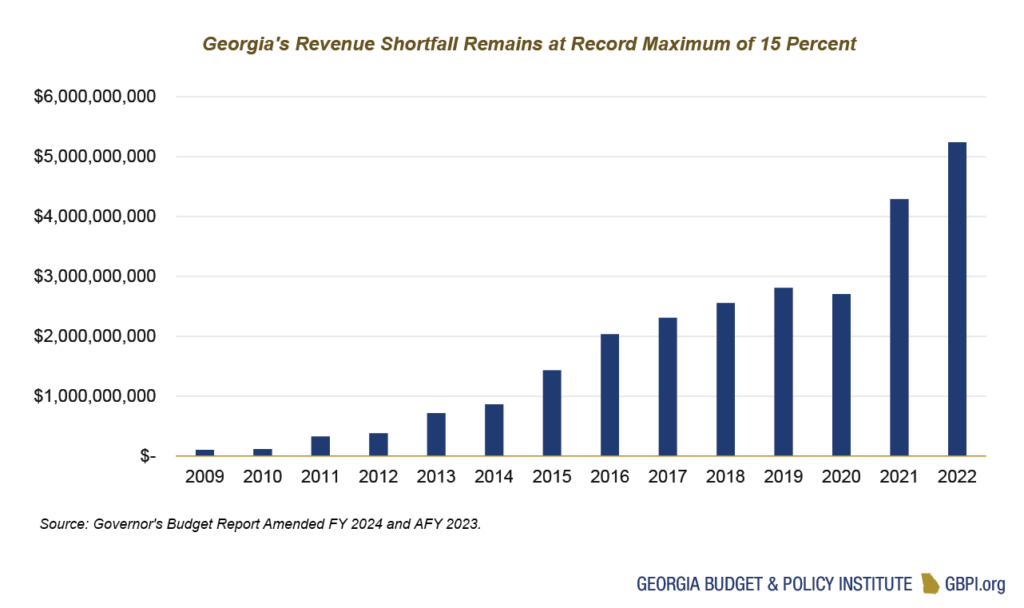

State Reserves Grow as Most Funds Remain Un-Spent

The Revenue Shortfall Reserve (RSR) was created in 1976 to help manage instability in revenue collections and hedge against the possibility of a recession. FY 2022 marks the state’s second consecutive year in which the fund has reached its maximum balance since expanding in 2011 to hold 15 percent of the prior year’s revenue collections.[17] On top of $5.2 billion available in RSR funds, the state maintains a balance of $7 billion in undesignated reserves, $1.9 million in Lottery/HOPE reserves and healthy fund balances across other accounts.

In AFY 2023, Gov. Kemp’s budget elects to use $1 billion of the state’s surplus funds to distribute one-time, flat refunds of $250 to single filers and $500 to married filers. Due to the recent suspension of the gas tax, the AFY 2023 executive budget accounts for approximately $1.1 billion in revenue lost during the first half of FY 2023. The governor’s AFY 2023 budget proposal also includes $1.1 billion to implement one-time property tax relief grants, valued at $20,000 of the assessed value for each homestead in the 2023 tax year.

The state faces urgent needs across government and is failing to fully offset increased costs for local districts due to the pending 67 percent increase in employer contributions for the State Health Benefit Plan. Rather than pursuing proposals for modest short-term relief, members of the General Assembly should work to target state dollars to achieve a lasting benefit. Furthermore, the governor’s proposal leaves significant levels of surplus funding unspent. Even if surplus funds are required to cover the projected fiscal impact of these three one-time changes, approximately $3.8 billion would remain in the state’s unobligated surplus account, which held a balance of approximately $7 billion at the conclusion of FY 2022.[18]

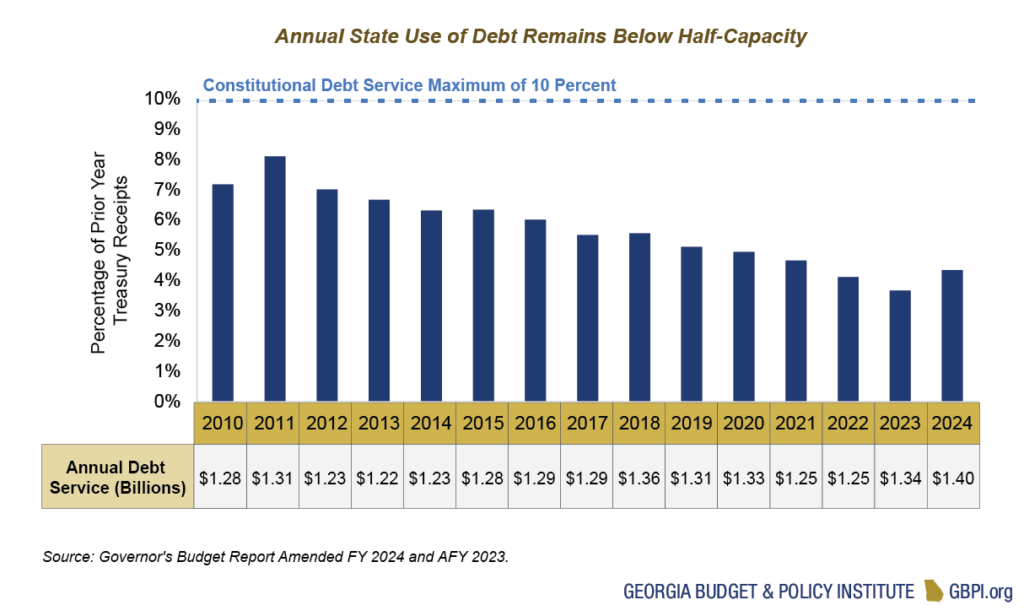

Although Georgia’s Constitution limits annual debt to 10 percent of the prior year’s revenue collections, the state projects its annual debt service to fall far below that limit at just 4.3 percent in FY 2024. Due to the state’s long-held AAA bond rating, Georgia can borrow at low-interest rates to finance capital projects. For more than 25-years, the Georgia has maintained its triple-A bond designation from all three ratings agencies, including during multiple years in which the state withdrew funds from its reserves. [19] During the eight-year period from 2011 to 2018, state use of debt averaged 6.4 percent.[20] Over the most recent four-year period and over the next two years, from 2019 through 2024, Georgia’s annual average rate of debt service would fall to less than 4.5 percent.

As Georgia makes less use of its capacity to borrow for investments in the state’s future, increased funding for student transportation remains an urgent need. This investment is a key area where the state’s low debt could be a vital asset in enhancing its financial power to make further improvements. As the state works to replace its aging fleet of school buses that transport more than 1 million students daily, only $23 million is included in the FY 2024 bond package to purchase 259 school buses statewide. The average cost of a school bus reported by Georgia districts was over $92,000 in 2017 and vehicle costs have continued to rise.[21] Moreover, as of 2018, approximately 3,500, or 24 percent, of daily route school buses were older than 14 years of age, suggesting significant funding is needed to fully upgrade the vehicles in use across the state.

Conclusion

As legislators tout the strength of the state’s economy and Georgia sits with a historic level of resources on hand, Gov. Kemp’s executive budget proposal falls short of meeting the needs of Georgia’s 11 million residents. For example, in the case of the promised $2,000 pay raise for certified educators, the state sets aside only enough funding to begin the raise in September, even though the fiscal year begins two months earlier on July 1. This change comes as school districts face demands to extend the pay raise to all employees—beyond the smaller pool of state-paid certified educators—and on top of hundreds of millions in new funding needed for rising employer costs for the State Health Benefit Plan. Meanwhile, the executive budget proposal’s one-time rebate for property tax assessments puts artificial pressure on local governments to diminish their revenues, even as the state attempts to push greater financial burdens down to school districts.

Gov. Kemp’s proposed FY 2024 budget also makes long-awaited progress across several policy areas. These priorities include investing $61 million to increase funding for Georgia’s HOPE Grant and HOPE Scholarship to cover tuition costs at a factor rate of 100 percent, up from 90 percent, reversing 2012 legislative changes that cut financial assistance for higher education. Under this change, full-time students would save an average of $444 per year.[22] This comes in addition to $10 million in funding for need-based college completion grants, after the General Assembly created the program during the 2022 Legislative Session.

Following the historic focus of the 2022 Legislative Session on increasing access to mental and behavioral health services, the FY 2024 executive budget proposal also adds $14.4 million to annualize 513 slots—and add 250 slots—for the NOW/COMP waiver program for individuals with intellectual and developmental disabilities, while dedicating 19.4 million to finance the costs of three additional behavioral crisis centers and added mobile crisis teams statewide. While this incremental increase is commendable, an estimated 7,000+ Georgians with disabilities are on waiting lists to access needed services—representing an urgent need for greater funding to improve access to services.[23]

For further context, in December of 2022, the bipartisan Senate Study Committee on People with Intellectual and Developmental Disabilities and Waiver Plan Access recommended adding state funding to open an additional 2,400 waiver slots in the FY 2024 budget.[24] The executive budget proposal includes $27 million to fund an adjustment in the school counselor-to-student ratio to reach 1-to-450, allowing the state to comply with legislation passed in 2013 (HB 283). This investment marks progress in meeting the state’s existing commitments, but still leaves Georgia schools far below the ratio of 1-to-250 recommended by the American Counselors Association.[25]

Major decisions loom as the General Assembly takes up Gov. Kemp’s budget proposals for AFY 2023 and FY 2024. Lawmakers will review the results of 10 audits on special interest tax breaks, made possible by transparency legislation approved during the previous session (SB 6, 2021). These reviews demonstrate that among the measures examined, the costs to Georgia taxpayers exceed the benefits generated in every case.[26] Beyond the billions in surplus funds available to the state, raising additional revenue by cutting back special-interest tax breaks could provide a path to revising the state spending plan and making Georgia’s tax code more fair. Further measures like raising the state’s antiquated tobacco tax rate to at least the national average could also help ensure sufficient resources are available to meet state needs. By addressing these issues, lawmakers can put Georgia on a path toward more equitable, long-term prosperity across all corners of the state.

End Notes

[1] Governor’s budget report amended FY 2024 and AFY 2023; Governor’s budget report amended FY 2009 and AFY 2008; Governor’s Office of Planning and Budget, Population projections visualization; U.S. Bureau of Labor Statistics, CPI inflation calculator, January 2008 to December 2022).

[2] Department of Administrative Services, Human Resources division. (2023, January). State of Georgia TeamWorks HCM System Fiscal Year 2022 Workforce Report: July 1, 2021 – June 30, 2022.

[3] Ibid.

[4] Department of Administrative Services, Human Resources division. (2023, January). State of Georgia TeamWorks HCM System fiscal year 2022 workforce report: July 1, 2021 – June 30, 2022.

[5] Owens, S. (2023, January 19). Insights 2023 | People-powered progress: Building change outside the statehouse. Georgia Budget & Policy Institute, from https://www.youtube.com/watch?v=BdtvQQK_RKU&feature=youtu.be

[6] Owens, S. (2022, August 9). Three ways to fix Georgia education funding. Georgia Budget & Policy Institute. Retrieved January 25, 2023, from https://gbpi.org/three-ways-to-fix-georgia-education-funding/.

[7] Chan, L. (2022, October 6). Keeping Georgians covered: Tools for minimizing the harm of the Medicaid unwinding. Georgia Budget & Policy Institute. Retrieved January 25, 2023, from https://gbpi.org/keeping-georgians-covered-tools-for-minimizing-the-harm-of-the-medicaid-unwinding/.

[8] Ibid.

[9] Ibid.

[10] Kaiser Family Foundation. Health insurance coverage of nonelderly 0-64, 2019. Retrieved January 24, 2023, from https://www.kff.org/other/state-indicator/nonelderly-0-64/?currentTimeframe=1&selectedRows=%7B%22states%22:%7B%22georgia%22:%7B%7D%7D%7D&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D.

[11] Chan, L. (2023, January 11). Money matters: Comparing the costs of full Medicaid expansion to the Pathways to Coverage program. Georgia Budget & Policy Institute. Retrieved January 25, 2023, from https://gbpi.org/money-matters-comparing-the-costs-of-full-medicaid-expansion-to-the-pathways-to-coverage-program/.

[12] Selig Center for Economic Growth. (2023, January). 2023 Georgia economic outlook. University of Georgia, Terry College of Business.

[13] Ibid, p. 5.

[14] Salzer, J. (2023, January 17). Georgia economy doing well, but stock market drop will hurt state revenue. The Atlanta Journal-Constitution. https://www.ajc.com/politics/georgia-economy-good-but-stock-market-drop-will-hurt-state-revenue/QZ7HFVX3T5BTXH3DNRCXJYAJPE

[15] Georgia Department of Revenue. (2022, December). Comparative summary of state general fund receipts for the month ended December 2022.

[16] House Bill 1437 (2022), as passed by the Georgia General Assembly and signed by Gov. Kemp

[17] Governor’s Budget Report Amended FY 2022 and FY 2023.

[18] Governor’s Budget Report Amended FY 2023 and FY 2024.

[19] The Pew Charitable Trusts. Rainy day funds and state credit ratings: How well-designed policies and timely use can protect against downgrades. https://www.pewtrusts.org/-/media/assets/2017/05/statesfiscalhealth_creditratingsreport.pdf

[20] Governor’s Budget Report Amended FY 2023 and FY 2024.

[21] Georgia Department of Education. (2018, August). Pupil transportation division quick facts.

[22] Bluestein, G. (2023, January 18). ‘Hallelujah.’ Many HOPE recipients in line for a boost. Atlanta Journal-Constitution. https://www.ajc.com/politics/politics-blog/hallelujah-many-hope-recipients-in-line-for-a-boost/CRBS2T2IBZD5FMH4WROFP7HSOU/?state=refreshTokenFallback

[23] Bunch, R. (2022, December 14). Georgia legislative committee proposes path to end disability services waitlist. GPB News. https://www.gpb.org/news/2022/12/14/georgia-legislative-committee-proposes-path-end-disability-services-waitlist

[24] Ibid.

[25] Owens, S. (2020, April 22). Crises demand counselors: Pandemic underscores need for more school counselors, mental health professionals. Georgia Budget and Policy Institute. Retrieved January 25, 2023, from https://gbpi.org/crises-demand-counselors-pandemic-underscores-need-for-more-school-counselors-mental-health-professionals/

[26] Salzer, J. (2023, January 17). Georgia economy doing well, but stock market drop will hurt state revenue. The Atlanta Journal-Constitution. https://www.ajc.com/politics/georgia-economy-good-but-stock-market-drop-will-hurt-state-revenue/QZ7HFVX3T5BTXH3DNRCXJYAJPE/