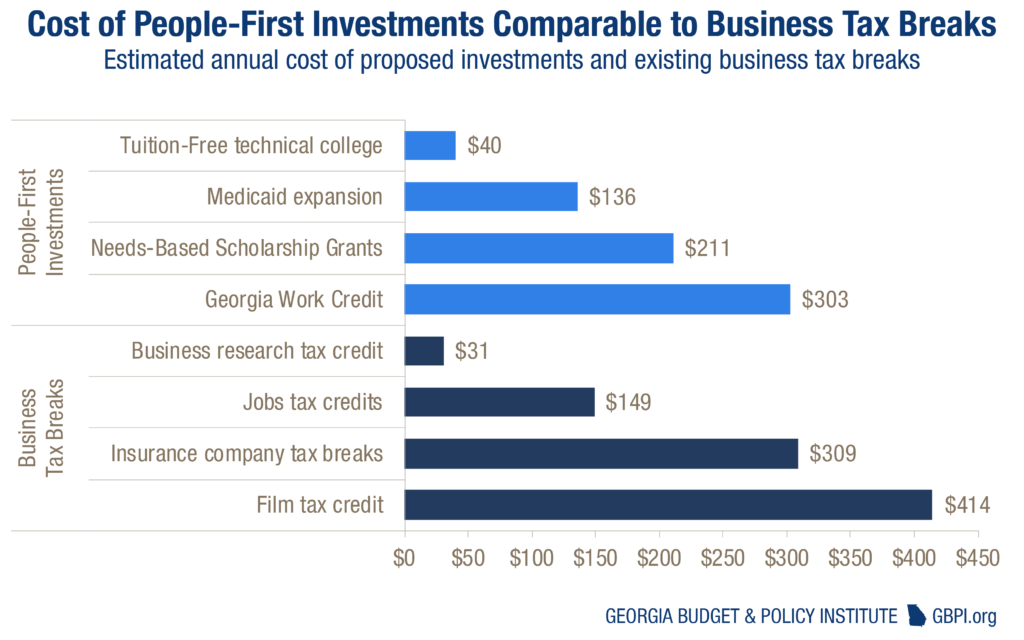

To achieve broad-based prosperity, Georgia must adopt policies that bolster investments in communities and empower more people to succeed. Such a strategy comes with a price for Georgia taxpayers, just like any effort to address shared challenges and pursue common goals. Making technical college tuition-free is likely to cost no more than $40 million per year[90], for example, while a new Georgia Work Credit set at a 10 percent match of the federal version comes in at $303 million annually. These people-first investments are comparable to amounts of money Georgia currently sets aside for business-first priorities, like insurance company tax breaks.

The full slate of recommendations in People-Powered Prosperity is likely to cost up to a few billion dollars each year. We propose that Georgia lawmakers can raise $1 billion in new annual revenues as a meaningful down payment on a people-first approach.

An investment of this scope is reasonable. Georgia levies relatively low taxes compared to other states and has ample room to raise new public funds without becoming an ultra-high tax state like California or New York. Georgia today ranks 42nd among the states in the amount of revenue it collects in state and local taxes as a share of the state’s personal income.[91] If lawmakers approved another $1 billion in one fell swoop, Georgia would still rank only 40th on that measure.[92] Just to reach the national midpoint, where half of states collect less revenue and half collect more, Georgia would need to raise state and local tax levels by almost $5 billion.[93]

An investment of this scope is reasonable. Georgia levies relatively low taxes compared to other states and has ample room to raise new public funds without becoming an ultra-high tax state like California or New York. Georgia today ranks 42nd among the states in the amount of revenue it collects in state and local taxes as a share of the state’s personal income.[91] If lawmakers approved another $1 billion in one fell swoop, Georgia would still rank only 40th on that measure.[92] Just to reach the national midpoint, where half of states collect less revenue and half collect more, Georgia would need to raise state and local tax levels by almost $5 billion.[93]

The relatively modest boost to state revenues needed to fund a down payment on this plan only requires a few extra dollars from taxpayers. An extra $1 billion in state revenue averages out to less than an extra $100 per person more than what Georgians contribute under today’s system.[94] The slightly higher tax levels would still rank low in historical terms. During the 1990s, Georgians contributed an average of 5.9 percent of their income to the state treasury once accounting for all state levies. Today, that rate is 5 percent.[95] Under this plan, it’s 5.2 percent.

Some Possible Options to Pay for a People-Powered Strategy

State lawmakers can pursue several straightforward options to pay for a robust public investment plan. Picking from the suggestions below or other revenue sources provides a responsible way for legislators to empower families today and build the state’s long-term foundation for economic success. Just these four options, for example, provide Georgia about $1.2 billion in new revenue for people-first investments each year. But this list is not exhaustive. Other viable and responsible revenue options exist as well.[96]

→ Trim back questionable tax breaks for big business

Each year, Georgia foregoes hundreds of millions of dollars through various credits and exemptions for private companies. Some tax breaks probably provide a good return on investment but others likely fail to deliver enough benefit to offset the state’s lost revenue. Unlike Georgia’s investments in education or health care, tax breaks are rarely reviewed to ensure effectiveness. Lawmakers can take a close look at tax breaks including those provided to insurance companies, which stand to claim an estimated $309 million worth of exemptions through two programs in 2018.[97]

→ Enact a corporate minimum tax

In the past, Georgia’s corporate income tax brought in more revenue to support the needs of the state’s communities. But profitable corporations worked for decades to carve out loopholes and avoid paying a reasonable share. Today, about 90 percent of businesses that file corporate income tax returns in Georgia report no taxable income at all.[98] One option common in other states is a corporate minimum tax, which ensures all corporations, including foreign companies doing business in Georgia, kick in at least a modest sum to help pay for public services and pro-family investments. Adding a new minimum tax set at $1,000 per corporation could generate about $250 million a year for people-first investments.

→ Increase the cigarette tax by $1 per pack

At 37 cents per pack, Georgia charges the third lowest cigarette tax in the nation and the lowest rate among its neighbor states.[99] Alabama, Arkansas, Florida, Kentucky, Mississippi, North Carolina and South Carolina all raised tobacco tax rates in recent years. If Georgia follows lead of its neighbors, it can raise substantial revenues while also helping achieve the vital public health goal of discouraging tobacco use. Hiking the state’s cigarette tax by $1 per pack could raise more than $400 million annually.[100] It would also keep Georgia in the lower-half of tobacco tax rates nationwide. The current median state, where half of states have higher tobacco taxes and half have lower ones, is South Dakota, where cigarettes are taxed at $1.53 per pack.

→ Extend the sales tax to cover some services

Georgia’s state sales tax policies are mostly unchanged from the 1950s and lag changing consumer spending patterns. The sales tax applies to most physical goods people purchase but few household services. A working-class Georgia family that buys a new lawnmower for their own yard pays sales taxes, while an affluent family that hires a lawn service company does not. Georgia can look for strategic ways to gradually extend the sales tax to more services without overburdening consumers. Applying the sales tax to repair and installation services for things like appliance installations and home renovation could net $239 million a year.[101]

Conclusion

Conclusion

A fairer Georgia with a stronger economy and more vibrant middle class is within reach. State lawmakers can wield proven policy tools to improve schools, smooth the path to higher education and lifelong learning, help keep people healthy and give more families a decent shot at a good quality of life. That can create a virtuous cycle of economic success. Stable families and productive workers lead to stronger economies, and stronger economies where people receive better education, better jobs and more income help build stronger families. That’s good for Georgia’s companies and communities. In fact, that’s good for everyone.

The 2018 statewide elections and turnover in the governor’s office offer a golden opportunity for the Peach State to embark on a people-powered path. It wouldn’t be the first time Georgia raised new revenues to tackle shared interests. In 1989, Gov. Joe Frank Harris bumped the state sales tax to 4 percent from 3 percent to invest in better schools. In 1992, Georgia voters approved the lottery as an indirect tax on gambling to improve access to college. And in 2015, Gov. Deal and leaders from both political parties came together to pass nearly $1 billion worth of taxes and fees to repair Georgia’s roads and bridges.

We’ve done it before. We can do it again. A Georgia where all people are free to realize their potential is worth it.

Table of Contents

-

Home

-

Overview: An Investment Plan to Unlock Georgia’s Economic Potential

-

Background: Georgia’s People Hold Untapped Value

-

Educated Youth

-

Skilled Workers

-

Thriving Families

-

Healthy Communities

-

Conclusion: Georgia Can Afford an Ambitious Investment in its People

-

CONTINUE READING – Acknowledgements and Endnotes