Key Takeaways

- The coronavirus pandemic and resulting economic decline could lead to steep revenue shortfalls without sufficient federal aid.

- In order to address the effects of the coronavirus, Georgia leaders must prioritize long-term recovery with investments in health, education, the safety net and other key programs and services.

- Lawmakers can modernize and improve the tax code by lifting the tobacco tax to the national average and rolling back special-interest tax breaks to fund a budget that addresses the immediate and longer-term needs of our state.

With three-quarters of the 2020 fiscal year complete, the state of Georgia stands at the edge of a looming fiscal crisis caused by the global coronavirus pandemic, which threatens to upend nearly a decade of gains that primarily recovered ground lost during the Great Recession.

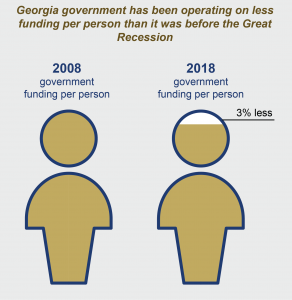

Under the amended 2020 budget signed into law by Gov. Kemp just as the coronavirus pandemic was nearly shutting down Georgia’s economy, many sectors of state government remain funded below their pre-recession levels when adjusted for population growth and inflation. As state leaders brace for unprecedented shortfalls in revenue collections, Georgia’s government operates with about 3 percent less funding per resident, about $892 million less per year overall, than it did prior to the Great Recession in FY 2008.

Under the amended 2020 budget signed into law by Gov. Kemp just as the coronavirus pandemic was nearly shutting down Georgia’s economy, many sectors of state government remain funded below their pre-recession levels when adjusted for population growth and inflation. As state leaders brace for unprecedented shortfalls in revenue collections, Georgia’s government operates with about 3 percent less funding per resident, about $892 million less per year overall, than it did prior to the Great Recession in FY 2008.

This structural deficit offers a sobering warning that must inform the state’s response to the next wave of expected revenue shortfalls. Those shortfalls will likely worsen in the months ahead as the economy digests the effects of mass layoffs that have caused over 850,000 Georgians to seek unemployment benefits, forced multi-sector businesses closures and created a dramatic drop in consumer demand. The effects of this ongoing, massive level of statewide economic and social disruption are expected to be felt through at least the 2021 fiscal year.

In light of the already-known levels of economic devastation, surging unemployment and the guidance for Georgians to exercise caution in the months ahead, state leaders should prepare for mounting revenue shortfalls through the final quarter of fiscal year 2020. The state should also plan to collect significantly less in revenue during the 2021 fiscal year than Gov. Kemp’s previous $28.1 billion baseline projection.

Without substantial federal assistance, the state of Georgia could exhaust the $2.7 billion in savings it has built up in its Revenue Shortfall Reserve Fund, while facing a steep decline in resources well into the 2021 fiscal year. Because of the precipitous nature of the state’s economic decline, it will remain difficult to forecast with any degree of certainty beyond the next fiscal year. However, if recent economic downturns offer any indication of what lies ahead, the state will have to rely on immediate federal assistance to avoid a sharp drop in funding for core areas like public education. Without bold and aggressive action, Georgia’s leaders could face a difficult road to make up ground lost in the months and years ahead.

Projecting the Effects of the Coronavirus Pandemic on FY 2020 State Revenues

Georgia operates on a fiscal year that extends from July 1 to June 30. Through the first 9 months of fiscal year 2020, monthly revenue reports indicate that approximately 72 percent of expected tax revenues for 2020 have already been generated by the state. General fund collections have registered slightly above the level needed to balance the FY 2020 budget, albeit under the state’s lowest expected rate of growth in a decade—with revenues before the coronavirus hit projected to increase just 0.7 percent over the previous fiscal year. And with the university system alone expected to lose $340 to $350 million in revenue through the summer, the state’s 2020 budget shortfall from April through June 30 is likely to exceed $1 billion, which would represent a 3.7 percent decline in expected revenues. Georgia’s FY 2020 shortfall could, however, be much larger depending on when the effects of declining personal and corporate income tax revenues reach the state’s coffers. At least temporary shortfalls are also likely to arise because of the unprecedented joint state and federal decision to delay the due date for filing and paying personal income taxes from April 15 to July 15, 2020.

National surveys of consumer spending suggest a 25-to-50 percent drop in sales has already occurred across most major sectors with some projections of upwards of a 90 percent decline in revenues generated by key state employers like Delta Airlines, signaling that the state can expect a large and immediate decline in sales tax collections. Georgia will get its first official glimpse of how the state’s shelter-in-place order has impacted economic activity when figures from the month of March begin to surface in revenue report that will become public in early May. If consumer activity in Georgia mirrors the median decline projected by key national data indicators, the state can expect an end-of-fiscal-year sales tax revenue drop of about $500 to $700 million below expected collections. Such a shortfall would correspond with a 30 to 40 percent average decline in taxable year-over-year sales through the final three months of FY 2020.

Federal Funds Will Help with State Coronavirus Response, But More Is Needed for Expected FY 2021 Fiscal Shortfall

Approximately $3.5 billion in state fiscal relief is headed to Georgia as a result of the federal coronavirus relief fund created by the Coronavirus Aid, Relief and Economic Security (CARES) Act recently signed by President Trump. These funds are to help mitigate costs associated with the pandemic and to help the state weather unexpected shortfalls. $600 million will also be made available to Georgia’s largest local governments with populations that exceed 500,000 residents. The U.S. Treasury Department has yet to clarify if state and local governments will, in fact, have wide discretion to use CARES Act funds to close expected shortfalls. If a more restrictive view is adopted, it will likely force Georgia to deplete much of its Revenue Shortfall Reserve. With about $2.7 billion available in the state’s rainy-day fund to help close potential shortfalls, Gov. Kemp will likely have latitude to see to it that Georgia finishes the 2020 fiscal year with as few budget disruptions as possible.

Looking ahead to 2021, however, the state faces a significant wave of unresolved challenges. In FY 2021, Georgia’s existing revenue estimate projects that just under 75 percent of $28.1 billion in state revenues will come from individual and corporate income taxes (51 percent) and the sales tax (24 percent).

The remaining funds needed to operate government come from other taxes and fees and the state-run lottery for pre-K and higher education.

In the aftermath of the Great Recession, Georgia’s year-over-year revenue collections for fiscal years 2009 and 2010 declined by 9.8 percent and 8.9 percent, respectively. During that period, federal relief was instrumental in helping to avoid catastrophic budget cuts. In FY 2010, $851 million in 2009 American Recovery and Reinvestment Act (ARRA) funds were used to help close fiscal shortfalls, and $1.3 billion in ARRA funds were used in FY 2011. During the 2011 fiscal year, federal assistance from the ARRA was enough to close about 35 percent of Georgia’s gap in revenues. Still, even after furloughing all state employees and implementing sweeping measures to cut spending, the following fiscal year, Georgia’s declining revenues forced another round of even deeper cuts to essential programs like K-12 public schools and the university system. Ultimately, it took eight years of slowly restoring funds to approach striking distance of the same level of per capita funding the state enjoyed before the Great Recession.[1]

The state of Georgia also lost approximately 338,500 jobs during the last recession. Through mid-April, more than 2.5 times that level, 858,000 Georgians or about 18 percent of the state’s workforce, have already filed claims for unemployment benefits. A survey of members of the National Association for Business Economics also projects that, at least in terms of unemployment, the crisis is likely to continue at least through the end of 2020, with the median consensus estimate projecting a national unemployment rate of 9.5 percent to conclude the year. Given the unprecedented surge in state unemployment claims, that figure may prove to be optimistic.

Sinking global economic demand will also have significant effects on Georgia’s economy, with sustained challenges likely for industries that rely on global commerce. Goldman Sachs projects that advanced global economies will shrink about 35 percent in the second quarter of 2020, quadrupling the previous record set during the 2008 financial crisis. Reduced global economic activity will be especially impactful for Georgia residents and businesses, as the state is the No. 12 most trade dependent state in the nation.[2] Due to these factors, and the extreme uncertainty in the weeks and months ahead, Georgia is likely to face a large revenue shortfall in the near term.

Record Surge in Unemployment Could Cause Significant Drop in Income Tax Revenues

If the state experiences a sustained unemployment rate of 10 to 20 percent, Georgia’s individual income tax revenues for the 2021 fiscal year could fall between $1.25 to $2.5 billion below their projected 2021 level. There is also likely to be a sharp drop in the state’s corporate income tax, which has seen an unusually steep increase since FY 2018 as a result of favorable tax changes and record stock prices. With the FY 2021 projection for corporate income tax revenues up 53 percent, or $530 million, from what was collected in FY 2018, the state is likely to see an equally sharp decline from the projected $1.5 billion in corporate income tax revenues that the FY 2021 budget is in part built around.

Historically, the corporate income tax has been among Georgia’s most volatile sources of revenue during periods of economic downturn. Between fiscal years 2008 and 2010, corporate income tax collections fell 42 percent. A similar drop would result in approximately $645 million less in revenue than is currently forecasted in the FY 2021 estimate. Taken together and based on how revenues responded to the 2008 downturn, individual and corporate income tax collections could fall approximately $2 to $3 billion below current FY 2021 projections.

If sales taxes are collected at a rate of 10 percent below what is currently projected for the 2021 fiscal year, it would mean a $670 million drop in expected revenues. That decrease would represent a positive growth rate several percentage points above the revised projection for sales tax collections that GBPI estimates the state is likely to generate in FY 2020. The performance of the state’s second largest revenue source will likely depend on the extent to which economic activity resumes during the fall and into next year. However, even under the most optimistic scenarios, it is unlikely that FY 2021 sales tax revenues will meet previous expectations and increase $272 million above the state’s pre-coronavirus projection of $6.45 billion for FY 2020, which is virtually certain to decline significantly over the final quarter of the fiscal year. GBPI’s analysis considers a decrease of $300 million in state sales taxes from current FY 2021 revenue projections to be the likely floor of what state appropriators can expect. A shortfall at or above $670 million is the more probable scenario based on previous economic downturns and the likely effects of continued guidance encouraging social distancing well into the 2021 fiscal year.

Georgia Policymakers Must Leverage FY 2021 Budget Decisions to Help Initiate Statewide Economic Recovery

Georgia is not alone in facing an unprecedented level of economic uncertainty as state leaders prepare to consider a budget for the next fiscal year. Like many states across the nation, the next steps of Georgia’s leaders will depend on action from Congress. Federal legislation focused on state fiscal relief would bring greater certainty to the state’s appropriations process by making available resources to help close a budget shortfall that could exceed $3 billion in FY 2021. Rather than forcing spending cuts that could negatively affect Georgia families for the next decade, state leaders should work with their federal counterparts to ensure a robust aid package is quickly deployed to help Georgia avoid state-driven layoffs, furloughs or deep cuts to essential programs like education, human services and Medicaid.

Before the coronavirus pandemic began, many of Georgia’s state agencies experienced budget cuts of 4 percent, which included the elimination of more than 1,200 vacant positions and added a heavier workload for many of the state’s vital employees who were already stretched thin. With substantial federal assistance, Georgia’s leaders can consider proactive ways to strengthen the state’s health care system, which has had extreme vulnerabilities and inequities exposed through some of the highest per-capita coronavirus death rates in America. State public schools shifting to online instruction has also placed a new spotlight on the lack of reliable internet access across much of rural Georgia. Investing in workforce development, rural broadband, and other growth-oriented measures will enhance the state’s economic recovery and put more Georgians in a stronger position to move forward once the shock of the coronavirus pandemic begins to ease. Ultimately, securing federal aid will be the first step to preparing a budget for FY 2021 that allows state leaders to focus on improving rather than cutting back essential functions of government.

To guard against large revenue shortfalls that could occur during the second half of the FY 2021 fiscal year and into FY 2022, Georgia’s leaders should complement federal aid with state efforts to improve revenue collections. Even if enough federal aid is made available to close immediate shortfalls, the state can likely expect a sharp drop-off in appropriations once the aid expires. Moreover, improving the state’s health care system, which boasts the third-worst rate of uninsured residents nationally, or expanding rural broadband to the estimated 1.6 million households without adequate internet access will require new resources over a sustained timeframe. There remain several bipartisan, consensus solutions available to Georgia’s leaders, which could result in hundreds of millions in additional revenues without worsening the effects of the current economic downturn.

Lifting the Tobacco Tax to the National Average

One of the quickest ways to improve state revenue collections by approximately a half-billion dollars per year would be to raise the state’s abysmally low tobacco tax of $0.37 cents per pack to the national average of $1.81 and to assess an equal levy to untaxed vaping products. Even before the coronavirus pandemic, costs paid by the state of Georgia to cover tobacco-related illnesses, which are estimated at $3.18 billion per year—including over $650 million in direct Medicaid costs—were known to far exceed the state’s $230 million in annual tobacco revenues. Making this common-sense change would save lives in the years ahead, while immediately boosting Georgia’s revenue outlook.

Evaluate Special-Interest Tax Breaks and Roll Back Transferability, Deferred Use of Credits

Part of what slowed the state’s revenue recovery from the previous recession was the presence and addition of billions of dollars in special-interest tax breaks built into the state’s tax code. The growth of these tax breaks helped undermine general revenue collections, resulting in stagnant levels of growth that slowed the state’s fiscal recovery, while leading to an estimated $9.8 billion in foregone revenue during the 2020 fiscal year.

Before the General Assembly suspended the state legislative session, lawmakers began debate over new limits to subsidies for film and production activities; there are currently no caps placed on the amount of credits that are available, and they often go to out-of-state companies. In a similar vein, the state has invested in tax credit programs to subsidize vouchers for private schools and rural hospital systems that have diverted state dollars away from direct funding of our health infrastructure and public education system.

Adding new restrictions to the transferability and deferred use of these tax credits would help improve revenue collections at a critical time. Similarly, eliminating some low-return tax credit programs in health care and education, in favor of more direct investments in public education and the state’s health care system, would likely boost revenue collections and improve outcomes in these areas. More generally, state leaders should scale back industry-specific tax subsidies that offer taxpayers little return on investment. Such a step would lift revenues and allow for more fiscally prudent investments.

As Georgia prepares to manage the coronavirus pandemic and seeks to avoid deep cuts to core areas of government, state leaders should encourage and leverage federal fiscal assistance, while working to maximize state revenue and budget resources. Making data-driven adjustments to our revenue system will help leaders improve economic opportunity for all Georgians and preserve and build on the gains made over the past decade.

Endnotes

[1] GPBI analysis of budgets from FY08-AFY2020.

[2] Governor’s Office of Planning and Budget. The governor’s budget report, amended fiscal year 2020 and fiscal year 2021. https://opb.georgia.gov/budget-information/budget-documents/governors-budget-reports