Adding Up the Fiscal Notes: Post Crossover Day 2018

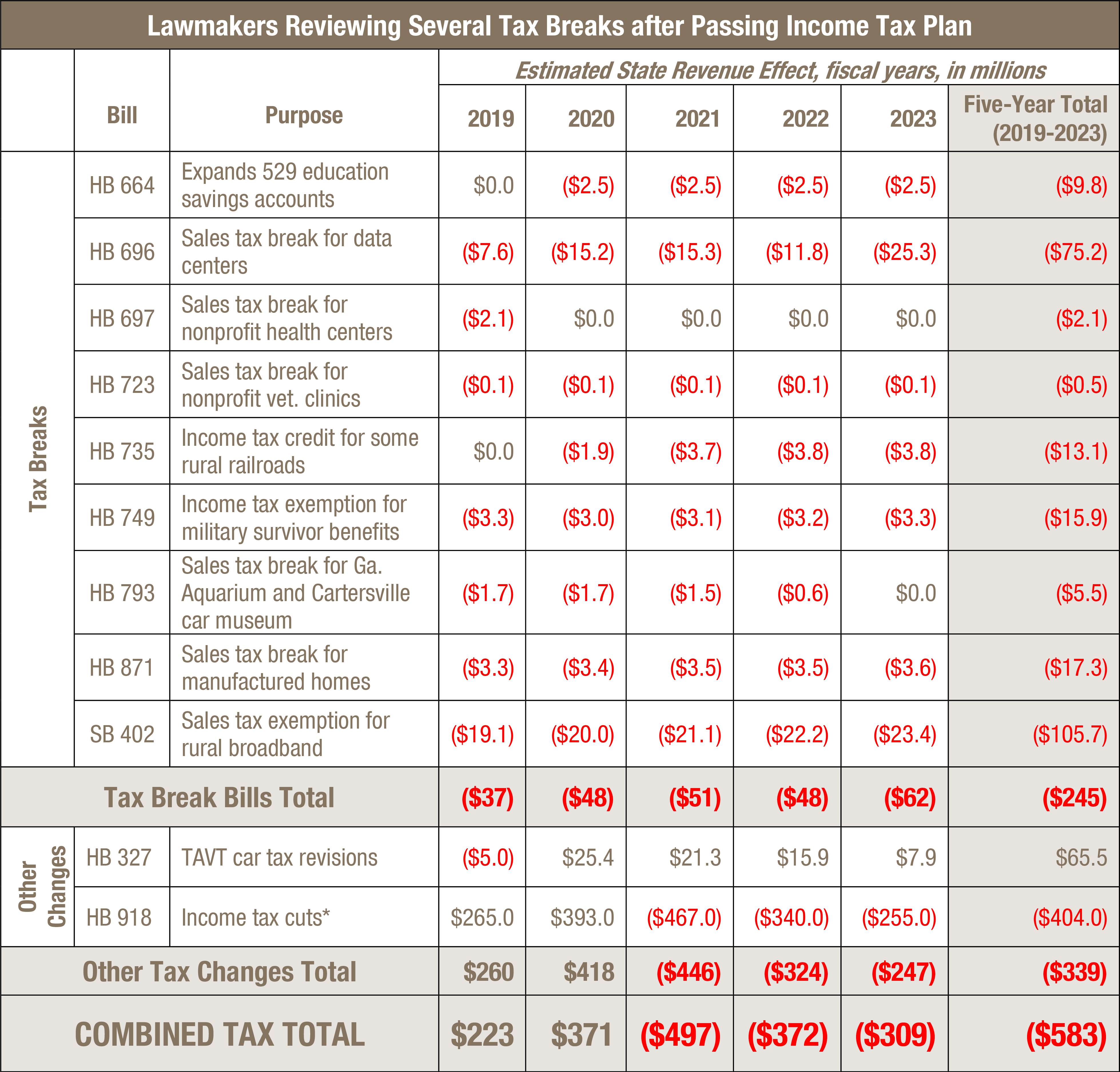

A range of tax bills are still in the pipeline at the General Assembly after lawmakers already approved a sweeping package of income tax cuts. Georgia’s 2018 General Assembly advanced 11 pieces of tax legislation by the Feb. 28 Crossover Day milestone that affect state revenues if approved by the House, Senate and the governor. Legislators will continue to debate these and possibly other tax measures until March 29, 2018, when the session is scheduled to adjourn for the year.

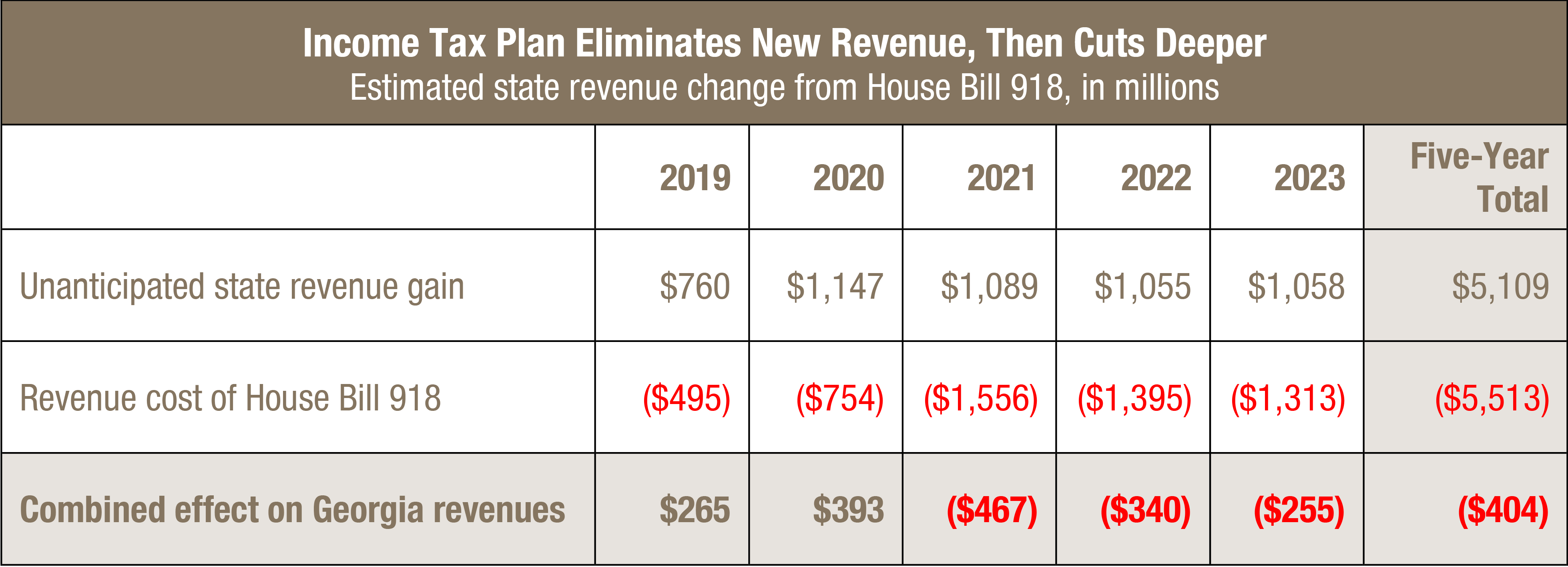

By far the largest and most important piece of tax legislation, House Bill 918, was a package of income tax cuts signed into law by Gov. Nathan Deal on March 2, 2018. Lawmakers pushed the cuts in response to perceived pressure to eliminate Georgia’s unexpected revenue gain stemming from interactions between state tax law and the federal tax package enacted in December. Georgia will collect an estimated $404 million less over the next five years than it if Congress had not tinkered with federal tax law. If lawmakers accepted the unanticipated revenue gain rather than hastily cut income tax rates, Georgia stood to gain about an extra $5.5 billion in revenue over the next five years.

Another proposal, House Bill 327, alters automobile taxing system so used and new cars are taxed the same way.[1] The potential change creates modest new revenue for both the state treasury and local governments. The remaining nine measures are tax breaks meant to advance specific policy goals including better access to nonprofit health centers, the construction of new data centers and the sale of mobile homes. The tax break bills combine for an estimated $245 million cost in lost revenue over the next five budget years, ranging from a low of $37 million in 2019 to a high of $62 million in 2023. Senators are already tweaking some of them.

Combined, the 11 tax bills alive after Crossover Day will cost an estimated $583 million in lost state revenue over five years if signed into law.

Some of this year’s remaining tax bills may serve worthwhile policy goals. But merits of individual proposals aside, state lawmakers should exercise caution on advancing additional tax break bills this year. The massive income tax plan signed into law by the governor could drain considerable revenues within the next few years. And other threats to Georgia’s budget loom on the horizon, such as possible federal budget cuts and the inevitability of another recession. Reports also indicate that state lawmakers are prepared to offer more than $1 billion in public subsidies to lure Amazon to choose a Georgia location for its second headquarters.[2] With such an unpredictable fiscal future, policymakers will be wise to proceed carefully before tinkering more with taxes this year.

[expand title=”About Adding Up the Fiscal Notes”]

Each year, the Georgia Budget and Policy Institute examines tax bills considered by the state Legislature and tallies potential costs in our two-part Adding Up the Fiscal Notes series. This analysis is a snapshot of the legislative state of affairs as of March 15, 2018. Watch for the second our part of the series after Gov. Nathan Deal’s May deadline for signing or vetoing bills passed by the 2018 Legislature.

[/expand]

Range of Tax Bills Moving through Legislature

The 11 tax measures approved by Georgia lawmakers or still pending after Crossover Day are listed in the table below and detailed later on in this report.

Notes: *HB 918 estimates show future revenue changes compared to prior year revenues, as opposed to against what revenues would have been had Georgia accepted the unexpected revenue gain caused by federal tax revisions. The estimates also assume that lawmakers carry through with the plan’s envisioned two-step process of cutting Georgia’s top personal income tax rate to 5.5% in 2020.

Income Tax Plan Eliminates Unexpected Revenue Gain, Then Cuts Deeper

In mid-January 2018, news stories emerged that federal tax changes signed into law by President Donald Trump in December might provide Georgia a lot of new state revenue, due to complex interactions between state and federal tax law. State experts generated several rounds of estimates, eventually pegging the revenue gain at $5.2 billion over six years if lawmakers followed their customary annual adjustments to federal tax changes.[3]

House Bill 918 emerged as the response of Georgia lawmakers to perceived pressure to eliminate the so-called windfall of new revenues and avoid an income tax increase. The legislation raced through the state’s General Assembly with little debate and the governor quickly signed it into law. The plan includes cuts to Georgia’s personal and corporate income tax rates and a doubling of the state’s standard deduction. The final version removed a sales tax break for jet fuel which was included in the original version of the bill.

The tax plan erases an estimated $1 billion a year in new revenue created by the federal tax revision. Then it cuts deeper into Georgia’s existing revenue stream. Rather than gaining about $5.5 billion over five years, Georgia loses about $400 million over that span. Additional costs could accrue in later years. Cutting income tax rates tends to cost more in the long-run than first anticipated, as experienced by states like Kansas and Louisiana.[4] More detailed GBPI analysis of House Bill 918 is available in “Lawmakers Might Come to Regret Georgia’s Risky Tax Plan.”

More Detail on Remaining Tax Bills

The list below briefly describes the remaining 10 tax bills pending before the General Assembly, ranging from an expanded exemption for private school savings to new tax breaks for railroads and rural broadband.

House Bill 327 cuts Georgia’s title ad valorem tax (TAVT) on cars to 6.75 percent from its current 7 percent and changes tax calculation on the sale of used cars. Combined, the two revisions might generate $66 million in new state revenue and $343 million in new local revenue over five years. Senators have already started to change to the bill substantitally.[5]

Senate Bill 402, known as the Achieving Connectivity Everywhere Act, adds a new sales tax exemption for purchases of broadband equipment within eligible counties, mostly in rural Georgia.

House Bill 664 doubles Georgia’s income tax exemption for donations to 529 savings plans, to $8,000 from $4,000 per student for couples and to $4,000 from $2,000 for single filers. Originally designed to encourage families to save for college, 529 funds can now be used to pay tuition at private K-12 schools due to changes in federal law.[6] It is one of several measures under the Gold Dome designed to divert public dollars to private schools.[7]

House Bill 696 creates a sales tax exemption for large-scale data centers such as the ones operated by large online companies such as Facebook and Google, at a cost of $75 million over five years.

House Bill 697 extends Georgia’s existing sales tax break for nonprofit health centers for another year.

House Bill 723 creates a sales tax break for nonprofit organizations that provide certain veterinary and disease monitoring services in Georgia.

House Bill 735 enacts a new income tax credit for railroad companies and other businesses that pay to maintain short-line railroads, which are low-traffic tracks typically found in rural areas.

House Bill 749 creates an income tax exemption for military survivor benefits, which are payments available to surviving family members of deceased veterans.

House Bill 793 extends Georgia existing sales tax break on construction materials for expansion of the Georgia Aquarium in Atlanta at a total cost of $4.5 million and creates a new one for building a car history museum in Cartersville at a cost of nearly $1 million.

House Bill 871 exempts the purchase of mobile homes from the state sales tax.

Endnotes

[1] “House votes to increase used car taxes,” Atlanta Journal-Constitution. 2/22/2018.

[2] Gov. Deal indicated last month that lawmakers could reconvene the legislature for a special session if the Amazon question warrants. “Georgia prepares for an unprecedented move to land Amazon,” Atlanta Journal-Constitution.

[3] Official fiscal note for HB 918 (LC 34 5383-ECS) dated 2/23/2018

[4] “What the Kansas tax cut about face means,” Brookings. June 2017.

[5] “Georgia Senate slams brakes on used-car tax change, again,” Atlanta Journal-Constitution. 3/15/2018

[6] “Preventing State Tax Subsidies for Private K-12 Education in the Wake of the New Federal 529 Law,” Institute on Taxation and Economic Policy. 3/2/2018.

[7] “Lawmakers Push to Shift Public Money to Private Schools,” GBPI. 3/5/2018.