Georgians face significant barriers in accessing economic opportunities and the ability to build wealth, resulting in Georgia ranking 11th lowest in the nation for home ownership and ranking second highest for student debt per borrower.[1]

One of the most powerful fiscal policy tools available at the state level to address financial barriers is the creation of a universal savings and investment account program. This program, popularly referred to as “Baby Bonds” in other state and federal proposals, would automatically enroll all Georgia children in long-term savings accounts with initial and recurring contributions made by the state of Georgia. It is designed to enable children of varying income levels to build assets beginning at birth so that by the time they graduate from high school, all children could be in position to afford the costs of higher education, homeownership or pursuing a business endeavor.

One of the most powerful fiscal policy tools available at the state level to address financial barriers is the creation of a universal savings and investment account program. This program, popularly referred to as “Baby Bonds” in other state and federal proposals, would automatically enroll all Georgia children in long-term savings accounts with initial and recurring contributions made by the state of Georgia. It is designed to enable children of varying income levels to build assets beginning at birth so that by the time they graduate from high school, all children could be in position to afford the costs of higher education, homeownership or pursuing a business endeavor.

Nationally, the top 10% of households hold 67% of total wealth, while the bottom 50% hold just 2.5% of total wealth. In terms of the racial wealth gap, Black families own about 23 cents for every $1 of wealth held by white Americans, in comparison to 19 cents for Hispanic Americans.[2] Scaling the level of initial contributions and recurring payments offers a mechanism to give lower income Georgians access to wealth-building tools, while targeting state resources to actively narrow generational disparities.

How Baby Bonds as proposed by HB 284 and HR 99 would work:

- All children born in Georgia would receive a minimum deposit of at least $250 at birth.

- Children who are covered by Medicaid or receive support from the Supplemental Nutrition Assistance Program (SNAP), or the Temporary Assistance for Needy Families (TANF) programs would receive an enhanced initial contribution of $1,000.

- Each year these children would receive annual contributions of $250, or $500 if they are among the group receiving enhanced initial contributions.

- Funds would be invested in multi-asset portfolios with oversight provided by the state to target low administrative costs. Families could also make contributions beyond the amount provided by the state to bundle other potential tax advantages, such as those offered under 529 investment accounts for education expenses. By enabling additional contributions, offering universal accounts brings on-line a powerful tool for families across the state to invest in the futures of their children.

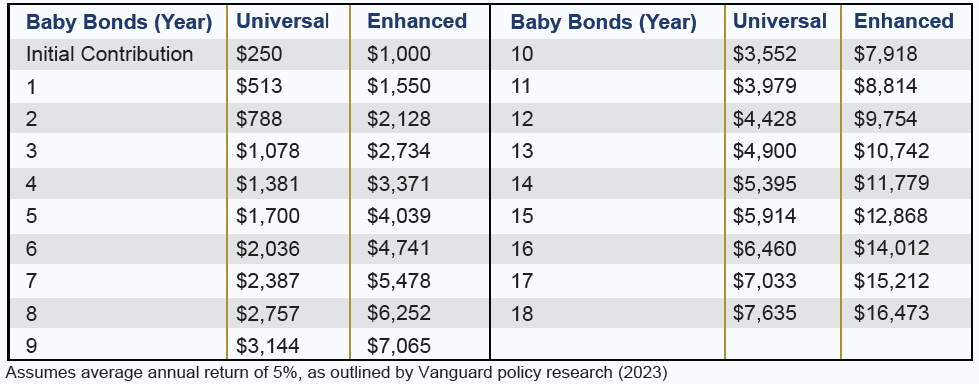

Assuming an average annual return of 5%, universal account holders would accumulate $7,600 over 18 years, in comparison to $16,500 for those with enhanced accounts.

The cost of seeding accounts for the 120,000 Georgia babies born each year would amount to just $70.5 million.[3] If the state scaled up the program to immediately enroll all children currently under 18, rather than just newborns added year-over-year, the cost of creating accounts for all 2.7 million Georgia children would amount to $1.3 billion. In future years, the cost of making recurring deposits to all 2.7 million children would be approximately $855.9 million per year.[4]

These investments could have meaningful effects statewide by offering all Georgia children a path to affording a higher education with minimal debt, home ownership, entrepreneurship or other opportunities to secure their livelihood or further grow their assets after reaching age 18.

Endnotes

[1] U.S. Census Bureau, Current Population Survey/Housing Vacancy Survey, March 12, 2024; Hanson, M. (2024, October). Student loan debt by state [2024]: average + total debt. Education Data Initiative.

[2] Kent, Ana Hernández and Lowell R. Ricketts. (2024). The State of U.S. Wealth Inequality. Federal Reserve Bank

of St. Louis.

[3] Georgia Department of Audits & Accounts. (February 17, 2025). Fiscal Note, House Bill 284 (LC 59 0055).

[4] Ibid.