The 2021 Legislative Session has officially ended. Much of the session was focused on efforts to undermine democracy and voting rights. Legislators also approved several bills that hinder economic prosperity and did not advance several measures that would put people first. However, some bills that passed do mark positive movement toward improved outcomes in our state. Several bills also failed to advance that would have undermined equity and economic opportunity in our state.

Georgia’s General Assembly convenes for only 40 days each year (unless there is a special session), and the governor now has 40 days to sign legislation. This was the first of a two-year session, so bills that were not passed or voted down can continue to move in 2022.

A Budget Should Reflect Georgians’ Priorities

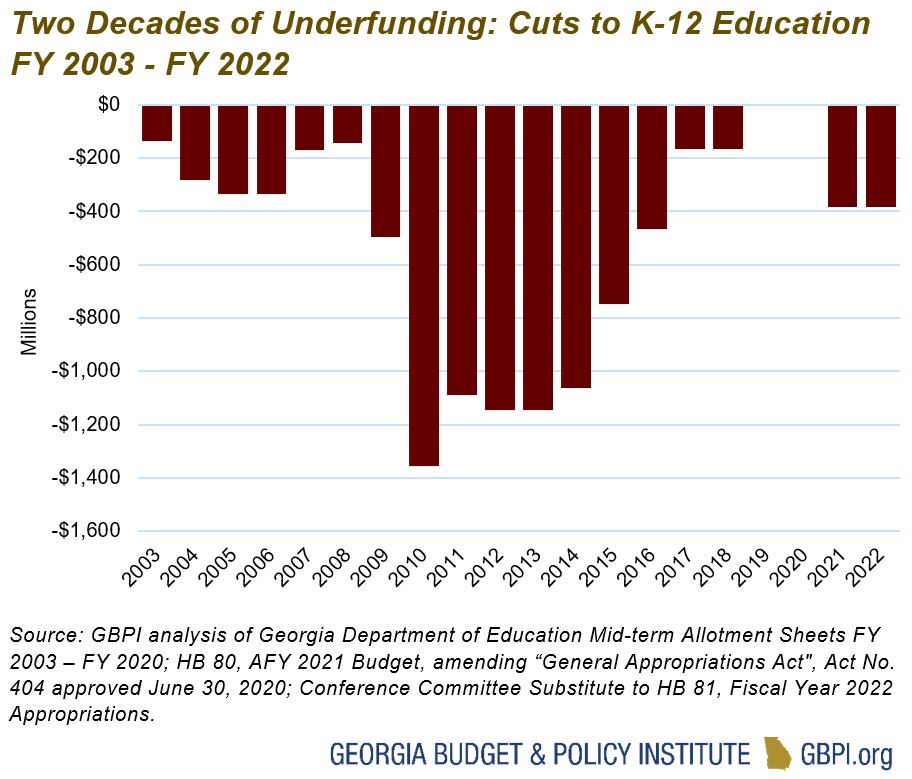

Georgia’s budget is a statement of the state’s values: Lawmakers’ choice to spend dollars in some areas and disinvest in others demonstrates their priorities. A budget has the power to reduce or exacerbate racial inequities and boost health and economic outcomes. Passed on the final day, the budget for Fiscal Year (FY) 2022 continues the state’s pattern of underfunding key priorities. The final bill includes improved funding for mental health services, rural health and other priorities, but still maintains the pattern of disinvestment and the underfunding of key programs and services that Georgia leaders have perpetuated since the Great Recession. Lawmakers made no move to restore cuts to public education, for example, claiming that federal funding coming to Georgia’s schools thanks to the American Rescue Plan (ARPA) is more than sufficient. This ignores the fact that school districts will now be forced to use those dollars to supplant state funds rather than support student and educator needs during and after COVID-19.

Moreover, although the budget recognizes the $12.5 billion provided to Georgia under the ARPA, it does not appropriate the $4.9 billion Georgia is receiving in direct funding and for capital projects such as broadband infrastructure. For lawmakers to be able to appropriate these funds, Gov. Kemp must revise the revenue estimate. Since he did not, those funds will likely be administered by the governor and his administration. While this may be appropriate in some cases, the best option to ensure these dollars are used to the benefit of the people is to include them in next year’s appropriation process.

GBPI will release more details on the final budget in the coming weeks.

Balancing Our Tax Code

Right now, Georgia’s tax code is out of balance, with the state giving away over $10 billion in tax breaks in FY 2022 that mostly benefit corporations and top earners while Georgians with low or moderate incomes struggle to pay their bills. By looking for commonsense options to improve revenues in our state, lawmakers can better fund priorities such as schools and health care and look for opportunities to close inequities in our state.

A risky and convoluted tax scheme known nationally as CAPCO but dubbed the Georgia Agribusiness and Rural Jobs Act (GARJA) credit reared its head in multiple forms this session. CAPCO is pitched as a job creation incentive, but in other states, few jobs have been created and they have come at high cost. Although this would be the second round of CAPCO funding, to date, the state has not yet evaluated the effects of the program, further calling into question the wisdom of doubling down with an additional $100 million in funding for a second round of grants. In this model, the state also takes on almost the entire risk of investing. This and a hefty tax break for Lockheed Martin were originally included in HB 587 and then added to SB 6, a bill that originally was meant to provide a mechanism to evaluate the state’s special-interest tax breaks.

These unnecessary tax subsidies are particularly costly right now, as the recently enacted ARPA includes a provision that if states use critical federal funds to enact tax cuts, the state will lose out on an equivalent amount of federal dollars. Late on Sine Die, CAPCO was removed from SB 6 and the legislation passed. It does still include other special-interest tax breaks, including the subsidy aimed at Lockheed Martin. HB 587 did not pass.

SB 148 also provided an opportunity to evaluate those special-interest tax breaks. Right now, the state has no evaluation process to ensure the $10 billion we hand out each year are improving outcomes in Georgia, even while those dollars could be used to support education, health, infrastructure and more. Unfortunately, SB 148 failed in the House, although similar legislation can be introduced in the future.

Another piece of legislation passed that, while admirable in aim, also risks some of the $4.7 billion in direct federal aid. HB 593 raises the standard deduction slightly, helping more working families keep some money in their pockets. However, families won’t see the complete benefit until they file taxes in 2023. Because this legislation may run afoul of the ARPA tax cut provision, it not only costs up to $199 million per year, but it could cause the state to lose up to an additional $199 million per year in federal funding until 2024—while providing a maximum benefit of $63 for married couples, just over $1 a week.

If lawmakers want to deliver even more meaningful relief without risking critical federal dollars, they should look to enact a Georgia Work Credit (GWC) modeled as a direct payment—similar to the federal stimulus checks—next year. A Georgia Work Credit, or state-level Earned Income Tax Credit, modeled as direct payments could deliver up to $500 in targeted relief to about 2 million Georgians without risking federal dollars. A GWC is a proven tool that boosts health and economic outcomes for children and their families. Three GWC bills, including bipartisan HB 510, were introduced this year, but none advanced out of their original chamber. They will still be live next session. These payments could also be included in the budget.

Another opportunity to rebalance our tax code while also promoting health can be found in HB 394, which lifts the tobacco tax on cigarettes, smokeless tobacco and vaping to the national average. Georgia’s tobacco tax currently ranks No. 49 out of 50 states, and we spend more on tobacco-related health issues than we recoup via the tax. HB 394 did not advance this year but can be considered during next year’s session.

Educated Youth

Georgia has a constitutional requirement to provide an adequate public education to all Georgia students, but often the General Assembly chooses to instead support vouchers, which funnel public dollars to private schools, even while underfunding our state’s K-12 public schools.

This year saw the return of several voucher bills, but only one passed out of both chambers: Senate Bill 47, which expands the eligibility of an existing school voucher for students with special needs. Unfortunately, any child who takes advantage would lose out on federal funding and certain civil rights protections.

Advocates and lawmakers did ensure House Bill 60 and House Bill 142 did not pass this year. HB 60 would have created a new voucher program; HB 142 would have expanded the existing tax-credit voucher program. Although they did not pass, there is still a risk that they move next year.

Unfortunately, lawmakers did not advance HB 10, which would create an Opportunity Weight to provide additional funding to schools serving students living in poverty. Additional funding for low-income students can fund transportation, additional teachers, emotional and mental health support, expanded curriculum and programming to support students. Hopefully this bill moves next session.

Healthy Communities

Georgia’s health care system is not meeting the needs of its diverse and growing population. Unfortunately, lawmakers again failed to pass the most critical legislation that would improve access to health care: full Medicaid expansion, which could cover around 500,000 Georgians who are not currently insured. New federal incentives in the ARPA mean that not only would the federal government pay for 90 percent of expansion, but Georgia would draw down additional federal dollars to pay for other health programs, help fund our schools and more. In recent years, the state has created a plan to extend Medicaid to some Georgians but included burdensome work reporting requirements that severely limit how many people could be eligible. Now, the federal government may revoke that work reporting requirement—which would allow more people to enroll but cause the cost of the plan to skyrocket. SB 172 and HB 630, which would both fully expand Medicaid, are more fiscally responsible options that would cover more people.

Lawmakers also did not advance proposals that would extend postpartum Medicaid, or Medicaid coverage for people who recently gave birth, to 12 months. Last year, the state approved postpartum Medicaid to six months post-birth, which will help improve both maternal and infant health. Extended coverage to 12 months is a cost-effective option to further boost outcomes. Although lawmakers improved funding for mental health services in the final version of the budget, they also failed to advance HB 49, which would require insurers to pay for behavioral health services at the same level as physical health services.

However, lawmakers did pass one bill that will help more families get the health care this year. HB 163 directs the Department of Community Health to submit a Medicaid waiver that would allow children whose families apply for the Supplemental Nutrition Assistance Program (SNAP, or food assistance) to automatically enroll in or renew their participation in Medicaid. This legislation simplifies the process for children in need of health care coverage and ensures more who qualify can get the care they need. It also saves money for state agencies.

A Strong Workforce

As Georgians in a variety of industries, particularly those that pay low wages, face continued unemployment in the wake of COVID-19, workforce development and access to higher education become even more important. SB 107, which waives tuition and fees for current and former foster youth, did pass, but several other bills to support higher education affordability stalled in the House. HB 87 would give students in associate degree programs at Technical College System of Georgia (TCSG) schools better state financial aid access. HB 88 and HB 256 would restore HOPE Grants to full tuition. HB 259 would provide additional financial aid to HOPE scholars based on financial need. These bills will still be live next year.

Thriving Families

Even amid the economic hardships wrought by the COVID-19 pandemic, lawmakers advanced few measures to support the state’s families. However, they did pass HB 146, which would extend three weeks of paid parental leave to state employees after birth, adoptions and foster placements. Although it is limited to State of Georgia employees, it will affect about 423,000 parents. The move will also help address disparities faced by women and people of color, as 66 percent of state workers are women and 55 percent are people of color.

HB 55, which would prohibit employers from asking about salary history in the hiring process, would help close pay gaps faced by women and people of color. Unfortunately, it stalled in the House but can be reconsidered next year.

Lawmakers also forwent an option to support families living in poverty. HB 91 would have lifted the benefit amount for Temporary Assistance for Needy Families (TANF, or cash assistance). The benefit level has not changed for 30 years and is set at just $280 for a family of three. These low levels are rooted in racism: Black children are likelier than Latinx and white children to live in the states with the lowest benefit levels.

A Fair Legal System

In spite of past reforms, Georgia leads the nation in the number of people on probation and in length of probation sentences. SB 105 is a step in the right direction. It will streamline the process for those who qualify for early termination of probation to do so. This bill passed out of both chambers.

Lawmakers also did not advance another bill that would have helped foster a slightly more just criminal legal system by increasing the jurisdiction of juvenile courts from age 16 to 17 for non-violent offenses so that 17-year-olds would not be tried for these offenses as adults. HB 272 made it out of the House but did not pass out of the Senate. It can be considered there next year.

SB 174, a bill to increase cash bail, passed late on Wednesday. Cash bail essentially forces people who are accused of crimes and do not have sufficient funds to be incarcerated before their trial, whereas wealthier people with more money can pay to wait out their trial at home, criminalizing poverty. SB 174 runs counter to the bipartisan work that has been done in recent years to improve the state’s criminal legal system.

A Welcoming Environment for Immigrants

By fostering a welcoming environment for the one in 10 Georgians who are immigrants, state leaders can enrich our communities, strengthen families and boost economic outcomes. One opportunity to improve Georgia’s environment for immigrants is by promoting college affordability for undocumented students. Right now, Deferred Action for Childhood Arrivals (DACA) recipients who live in Georgia currently pay the out-of-state tuition rate, which is up to three times the rate for in-state tuition. HB 120 would allow the boards of the University System of Georgia and Technical College System of Georgia to set tuition somewhere between in-state tuition and an amount up to 10 percent higher for DACA recipients who currently pay out-of-state tuition. This legislation could benefit up to 20,380 young people in Georgia who participate in the DACA program. Although it is still in the House, the legislation does have bipartisan support and could become law next year.

Another opportunity to improve outcomes for Georgia’s immigrants comes in HB 833, which would expand access to a driver’s card to immigrants lacking legal status, as well as survivors of domestic abuse, returning citizens and trans Georgians, promoting family unity and enhancing road safety. A driver’s license or card is frequently necessary to navigate everyday tasks like driving to work, picking up groceries and dropping kids off at school. This legislation was introduced on the last day of session but could become law next year.

Lawmakers did approve HR 11 to create a House Study Committee to identify and remove barriers to full economic participation faced by immigrants and refugees in the State of Georgia. GBPI looks forward to seeing the findings from this study committee.

Looking Ahead

Whenever lawmakers return to the Gold Dome, they can and should pursue the myriad bills that did not pass this year that would promote prosperity in our state, such as a Georgia Work Credit, Medicaid expansion, a new limit for TANF benefits, an Opportunity Weight and more. Many of these priorities are part of GBPI’s People-Powered Prosperity campaign, which seeks to leverage the economic power of our state’s people.

This year was the first of a two-year session. Except where legislation has passed out of both chambers or failed, any of these bills could be considered in 2022. Georgia may also be looking at a special session for redistricting. Given the $4.9 billion from the federal government that has not yet been appropriated, Gov. Kemp would be wise to also use the special session to restore budget cuts and fund programs and services that help Georgians thrive.